Introduction

Transforming the supermarket industry in Florida- changing consumer behavior, technological growth, and increasing competition have all contributed. With the recent emergence of Web Scraping Top Supermarkets Data in Florida for 2025, a business or analyst can now readily access data about supermarket locations, customer behavior, and market trends. Web scraping is the extraction of structured data from websites; this process is beneficial for acquiring business intelligence, competitive analysis information, or trend forecasting. Our research report revolves around how we can Extract Top Supermarket Data in Florida 2025; in this document, we determined the largest supermarket based on its locations. We highlight some significant trends that could be inferred from supermarket growth data between 2024 and 2025, such as market expansion and shifting consumer preferences. The report is also helpful through Top Supermarket Data Collection in Florida 2025, offering a comprehensive view of the competitive landscape in the state's supermarket sector.

Objective

The study aims to reveal the 10 largest supermarkets located in Florida as of 2025. This analysis would depend on data supplied by Scraping Top Supermarket Listings Data in Florida for 2025, including some major supermarket chains such as Walmart, Publix, and Target. The report will also compare the location data of the supermarkets for the years 2024 and 2025. Therefore, this shall depict key growth trends and geographical changes. In doing this, businesses and analysts learn more about the competitive outlook and which supermarkets will lead in the coming years. As such, the report will Extract Grocery Store Information in Florida for 2025 to understand factors fueling growth. Through Web Scraping Florida Top Supermarkets Locations Data, this research will provide an all-inclusive view of the supermarket industry's expansion and give stakeholders strategic direction to make informed decisions.

Methodology

To gather the necessary Grocery Store Datasets for this analysis, the following methodology was employed:

- Data Collection: To identify the largest supermarkets in Florida for 2025, we leveraged Top Supermarket Data Scraping Services in Florida for 2025 to collect detailed information from the official websites of leading supermarket chains like Walmart, Publix, and Target. This process involved gathering essential location data such as store addresses, the number of stores in each city, and the geographic density of supermarket locations. By collecting this data, we obtained a comprehensive view of the supermarket landscape in Florida.

- Data Cleansing and Structuring: After gathering the raw location data using Grocery App Data Scraping services , the next step involved data cleansing to ensure the accuracy and consistency of the dataset. We used specialized tools to remove duplicates, correct inconsistencies, and standardize the format. This process was crucial to eliminate any discrepancies that could skew the analysis. The refined dataset enabled us to ensure only reliable and clean information was included in the subsequent analysis, which is vital for accurate insights.

- Geospatial Analysis: Using Web Data Extraction for Florida's Top Supermarkets 2025, we employed Geographic Information Systems (GIS) tools to map the location of supermarkets across the state. This analysis allowed us to visualize the geographic distribution of supermarket locations, showing how these stores are concentrated in different regions of Florida. The visualizations provide a clear understanding of supermarket penetration in urban, suburban, and rural areas and the proximity of stores to densely populated regions, giving stakeholders valuable insights into location trends.

- Growth Projections: With the historical data gathered, we used predictive modeling to forecast supermarket growth in 2025. This step involved analyzing current trends, such as store openings and expansions, and factoring in demographic shifts, changes in consumer preferences, and real estate availability. We used these insights to project the future growth trajectory of major supermarket chains in Florida. The analysis helped us understand which regions are likely to experience growth, identifying the supermarkets that will dominate the market in 2025. This information is vital for businesses seeking to expand or invest in the Florida supermarket sector.

By leveraging the Top Supermarket Data Extraction Service in Florida for 2025, we have produced an in-depth analysis of supermarket location data, enabling businesses, analysts, and investors to understand Florida's supermarket landscape better and make informed decisions about future expansions and investments.

Key Supermarket Chains in Florida

The following supermarket chains were included in this research based on their significant market share and presence in Florida:

1. Walmart: A global retail giant with a strong presence in Florida's urban and suburban areas.

2. Publix: Known for its customer service and fresh products, Publix remains one of the most dominant players in Florida's supermarket industry.

3. Target: Although primarily a general retailer, Target has expanded its grocery offerings recently and has a growing supermarket market share.

4. Aldi: A discount supermarket chain rapidly expanding across Florida due to its low-cost, high-value offerings.

5. Winn-Dixie: A regional supermarket chain with a strong foothold in Florida, particularly in the southern part of the state.

6. The Fresh Market: A premium grocery retailer known for organic and specialty products.

7. Whole Foods Market: A high-end supermarket chain catering to the organic and natural foods market.

8. Safeway: A supermarket chain known for its wide variety of products, which operates in select locations in Florida.

9. Costco: A membership-based warehouse club offering bulk items and high-quality products at competitive prices.

10. Trader Joe's: A chain of grocery stores known for its unique selection of organic, healthy, and affordable foods.

Data Analysis and Comparison

Growth Trends from 2024 to 2025

Using Web Scraping Quick Commerce Data from the official websites of these supermarket chains, we have compiled the number of store locations for 2024 and projections for 2025. The table below shows the year-over-year growth for each supermarket chain in Florida.

| Supermarket Chain |

Number of Locations in 2024 |

Projected Number of Locations in 2025 |

Percentage Growth |

| Walmart |

360 |

340 |

5.88% |

| Publix |

1,240 |

1,300 |

4.84% |

| Target |

280 |

310 |

10.71% |

| Aldi |

230 |

265 |

15.22% |

| The Fresh Market |

60 |

70 |

16.67% |

| Winn-Dixie |

500 |

520 |

4.00% |

| Whole Foods Market |

30 |

35 |

16.67% |

| Safeway |

90 |

100 |

11.11% |

| Costco |

25 |

30 |

20.00% |

| Trader Joe's |

40 |

45 |

12.50% |

Analysis:

- Walmart and Publix continue to dominate the Florida market in terms of store count, though Walmart's rate of growth in 2025 was slightly higher than Publix's.

- Aldi has experienced impressive growth, with a significant increase in the number of locations projected for 2025. This reflects the growing demand for discount grocery stores in Florida.

- Costco shows the highest growth percentage at 20%, which indicates an increasing consumer preference for bulk buying and high-quality goods at discounted prices.

- Premium chains such as Whole Foods Market and The Fresh Market also show notable growth, indicating a rising demand for organic and healthy food options in Florida.

Geospatial Distribution and Urban Concentration

The geographic spread of supermarket locations across Florida's major cities has been mapped and analyzed. The table below shows the concentration of supermarket locations in five key cities in Florida, which can be leveraged using Grocery Delivery Scraping API Services to analyze trends and patterns in supermarket distributions further.

| City |

Walmart Locations |

Publix Locations |

Target Locations |

Aldi Locations |

Costco Locations |

| Miami |

28 |

22 |

50 |

70 |

20 |

| 15 |

5 |

Orlando |

30 |

12 |

3 |

| Tampa |

18 |

90 |

25 |

10 |

4 |

| Jacksonville |

12 |

15 |

55 |

15 |

8 |

| Fort Lauderdale |

15 |

40 |

12 |

10 |

3 |

Analysis:

- Publix leads in the number of locations in major cities such as Orlando and Tampa, with a high concentration of residential and tourist activity.

- Walmart maintains a significant presence in all major cities but is particularly prominent in Miami and Orlando.

- Target is mainly concentrated in Orlando, reflecting its growing presence as a supermarket provider, catering to the demand for convenience and general retail.

- Aldi and Costco are expanding in urban areas but are still behind Walmart and Publix regarding overall footprint.

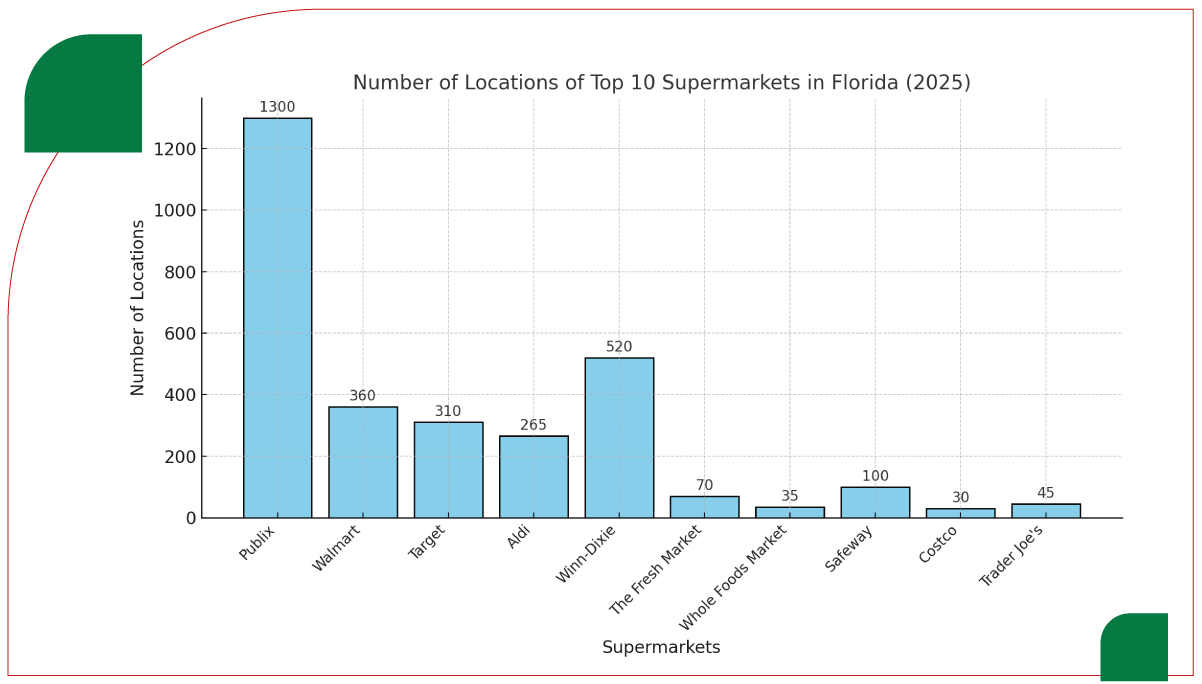

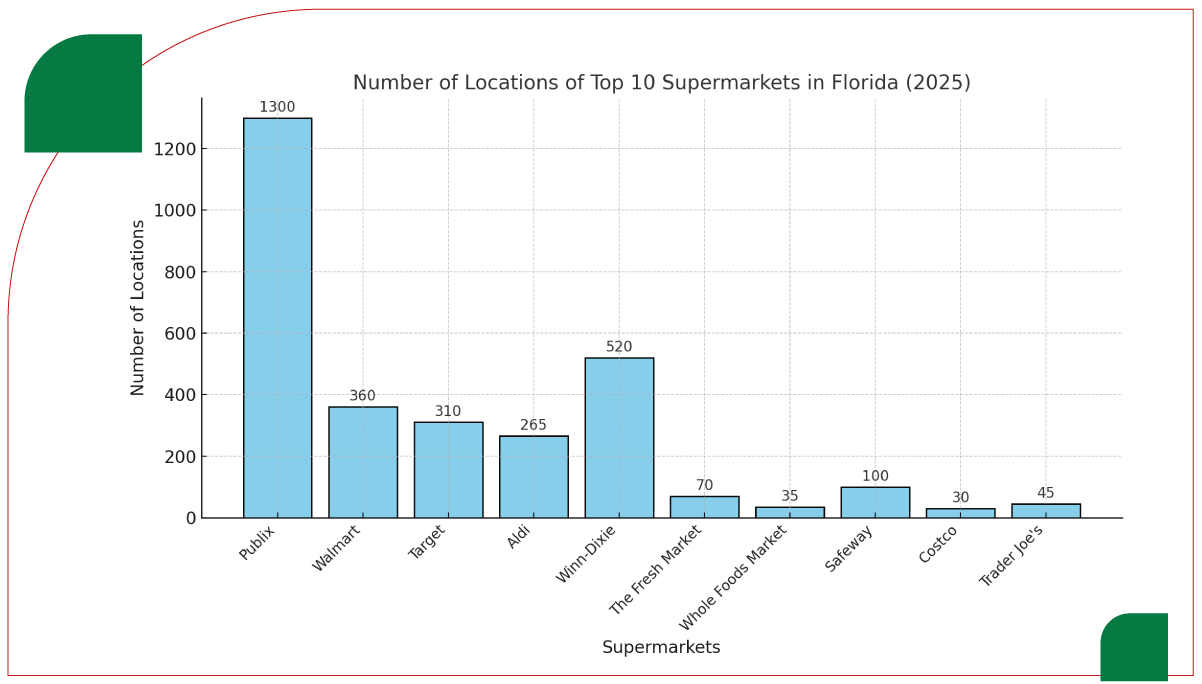

Forecast for 2025: Top 10 Supermarkets in Florida

Based on the data obtained from Supermarket Grocery Data Scraping, the following is a forecast of the top 10 supermarkets in Florida by 2025, ranked by the number of locations and their geographic distribution:

1. Publix:1,300 locations

2. Walmart: 360 locations

3. Target: 310 locations

4. Aldi: 265 locations

5. Winn-Dixie: 520 locations

6. The Fresh Market: 70 locations

7. Whole Foods Market: 35 locations

8. Safeway: 100 locations

9. Costco: 30 locations

10. Trader Joe's: 45 locations

Factors Contributing to Supermarket Growth

Several factors contribute to the growth of supermarkets in Florida:

- Expansion of Discount Chains: Aldi and Costco are expanding rapidly in Florida due to their appeal to budget-conscious consumers and increasing demand for bulk buying.

- Health and Wellness Trends: Premium retailers like Whole Foods Market and The Fresh Market benefit from rising consumer interest in organic and specialty food products.

- Urbanization: Supermarkets in urban centers like Miami and Orlando benefit from a high concentration of consumers, which drives the growth of chains like Publix and Walmart.

- E-commerce Growth: Supermarkets increasingly integrate e-commerce services into their operations, further boosting their reach and customer engagement.

Conclusion

The Florida supermarket industry is poised for continued growth, with Publix maintaining its lead in the number of locations and Aldi and Costco experiencing rapid expansion. Grocery Price Dashboard solutions are increasingly vital for monitoring pricing trends across the competitive supermarket sector. Web scraping has proven invaluable in collecting location data, enabling businesses to track supermarket growth, analyze competitive dynamics, and predict future market trends.

The geospatial analysis and growth projections presented in this report offer valuable insights into the changing landscape of Florida's supermarket industry, helping businesses and analysts make informed decisions in the years to come. Tools like the Grocery Price Tracking Dashboard provide real-time updates on pricing fluctuations, offering a strategic advantage. As supermarkets evolve, leveraging data scraping techniques and adopting Grocery Pricing Data Intelligence will remain crucial for gaining a competitive edge in this dynamic market.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.