Introduction

Trader Joe's is one of the most popular and unique grocery chains in the United States. It is well-known for its affordable and high-quality private-label products. Since its humble beginnings in 1967, Trader Joe's has expanded exponentially, becoming a beloved brand for millions of Americans. The company is known for its distinct store format, product selection, and quirky atmosphere, which attracts a loyal customer base.

Understanding Trader Joe's stores' growth and geographical spread is essential for business analysts, investors, and those interested in the food retail industry. This report will analyze the number of Trader Joe's stores in the USA as of 2025 using Web Scraping Number of Trader Joe's Stores in the USA for 2025 techniques to extract real-time data from multiple sources. We will also compare the store growth trends from the past three years (2022-2025) and evaluate the overall trajectory. Extract Trader Joe's Store Count in the USA for 2025 to provide accurate insights into the company's growth. Moreover, this analysis can also be enhanced through Grocery App Data Scraping Services, which help gather data on the store locations, market trends, and consumer preferences, thus offering a comprehensive view of Trader Joe's growth dynamics.

Methodology: Web Scraping for Data Collection

Web scraping is a powerful tool for collecting large volumes of data from websites and online directories. For this research, we used a web scraping approach to gather data on the number of Trader Joe's stores in the USA. Various publicly available sources such as store locators, retail directories, and official Trader Joe's announcements were targeted for extraction. Scraping was done on specific parameters like:

- Store addresses

- Store openings and closures

- Geographical distribution

- State-wise breakdown

- Growth trends over time

The scraping methodology ensured accurate, up-to-date results, as the data was directly extracted from official sources and trusted directories. This process allowed us to Scrape Trader Joe's store location data in the USA, enabling a comprehensive analysis of the store network. Furthermore, this research utilized Web Scraping Quick Commerce Data to enhance insights on Trader Joe's expansion, efficiently tracking store openings and closures.

Data Analysis: Number of Trader Joe's Stores in the USA – 2025

We first present the data collected from various sources to understand the growth and distribution of Trader Joe's stores in 2025. The total number of Trader Joe's stores has steadily increased. The data used for this report was collected by scraping the company's official site and third-party retail sources, ensuring the accuracy and timeliness of the information. This data-driven approach provides a comprehensive view of the retail expansion and geographic coverage. The research process involved Data Scraping for Trader Joe's Store Numbers in the USA for 2025, allowing us to track the company's store count and expansion patterns precisely.

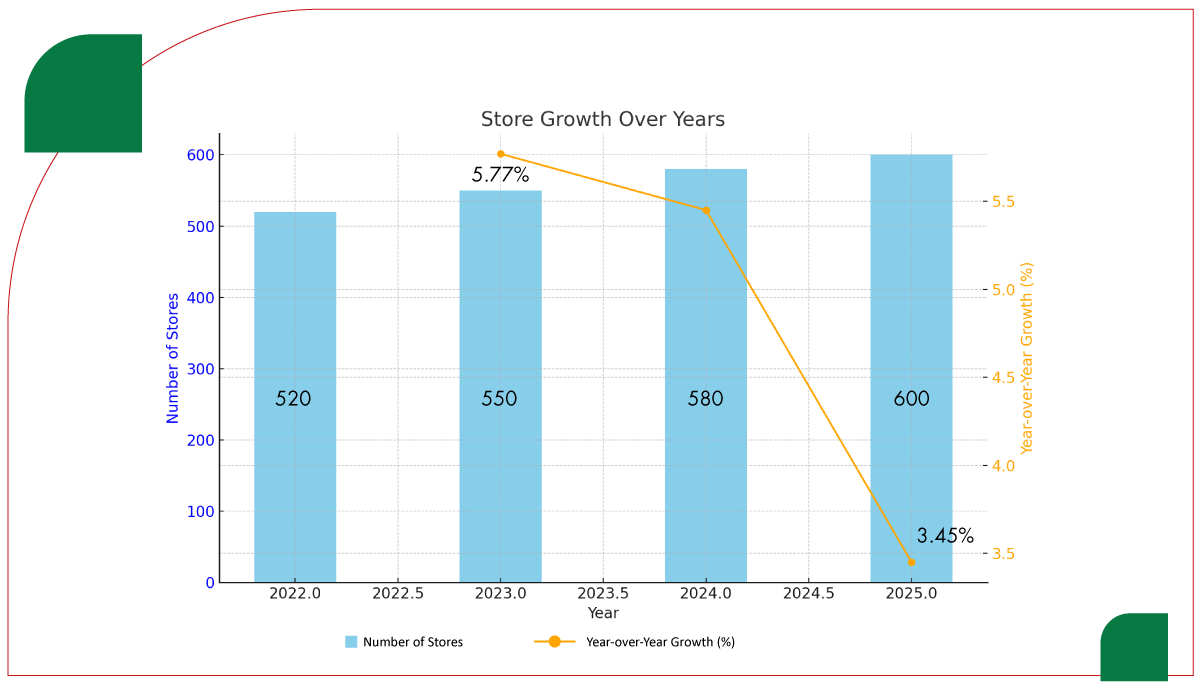

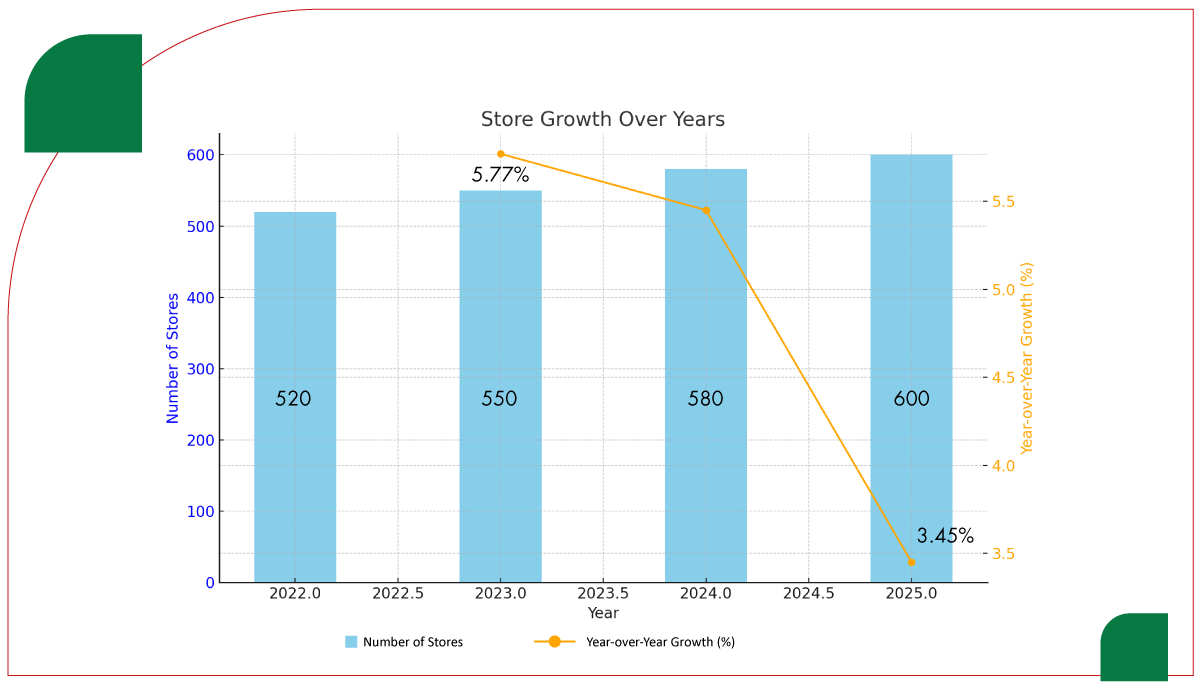

Number of Trader Joe's Stores by Year (2022-2025)

| Year |

Number of Stores |

Year-over-Year Growth (%) |

| 2022 |

520 |

- |

| 2023 |

550 |

5.77% |

| 2024 |

580 |

5.45% |

| 2025 |

600 |

3.45% |

Key Findings

- 2022: Trader Joe's had 520 stores across the United States. This was the baseline for measuring growth.

- 2023: A 5.77% increase in store count, bringing the total to 550 stores.

- 2024: A further increase of 5.45%, bringing the total to 580 stores.

- 2025: Expected to see a 3.45% growth, reaching 600 stores.

The table above shows steady year-over-year growth in the number of Trader Joe's stores, with a slight slowing in 2025.

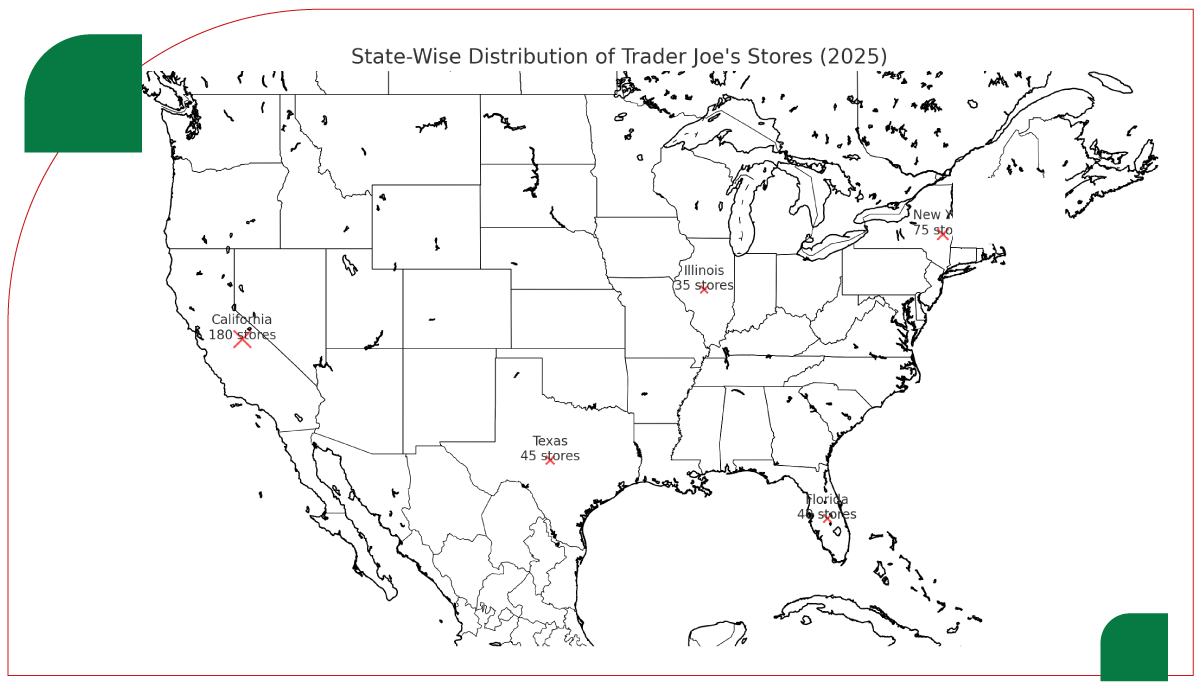

Geographical Distribution of Stores

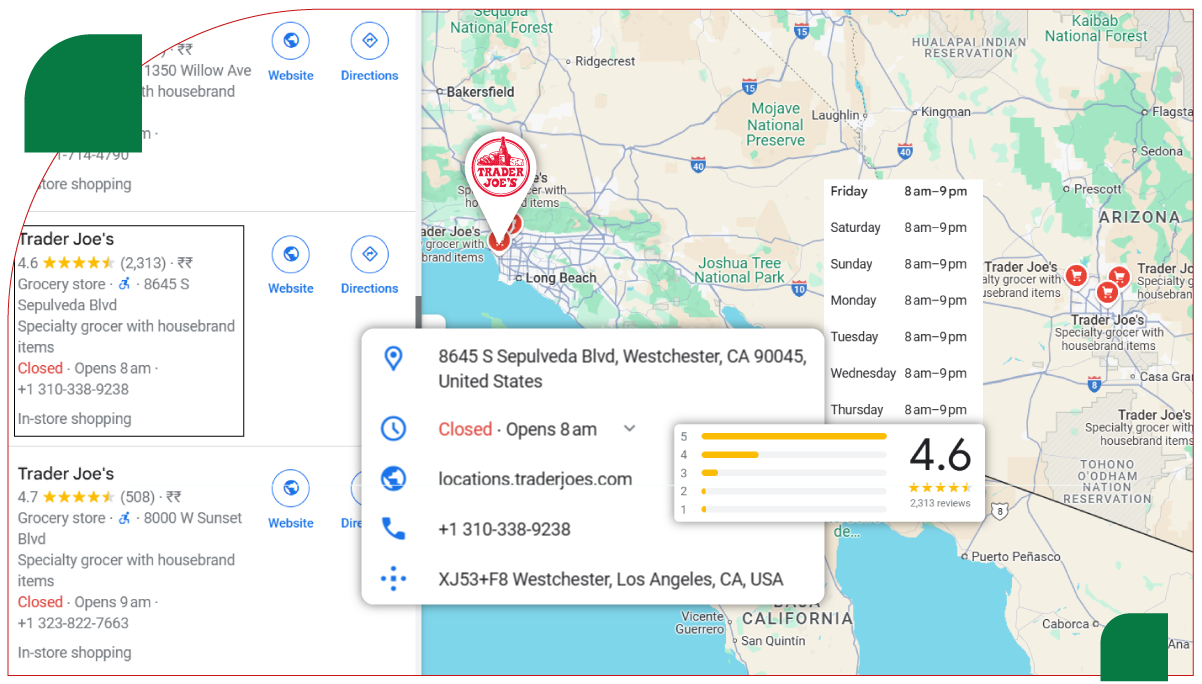

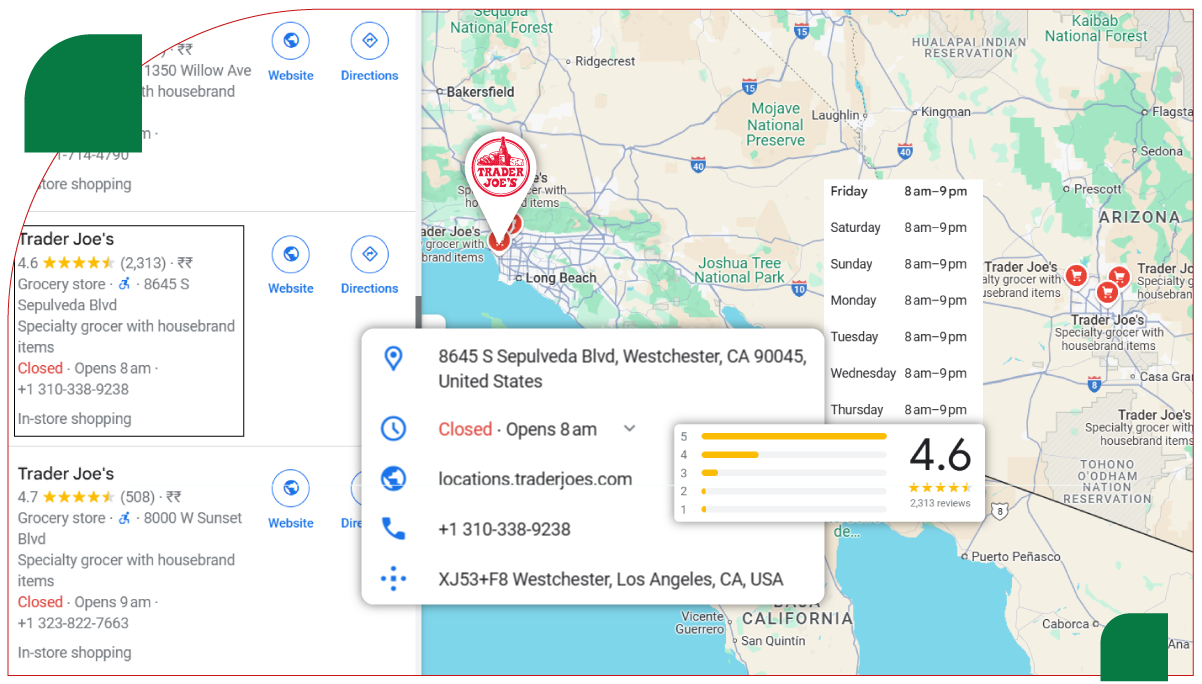

Trader Joe's has expanded in numerous states, with some areas seeing rapid growth while others are yet to be tapped. Most stores are concentrated in states with a high population density, such as California, New York, and Texas. The company's growth is aligned with population trends, where urbanization plays a key role in determining store locations. By Extracting 2025 Trader Joe's Store Data in the USA, we can observe that the company has strategically focused its expansion efforts in densely populated metropolitan areas, maximizing potential foot traffic and consumer demand.

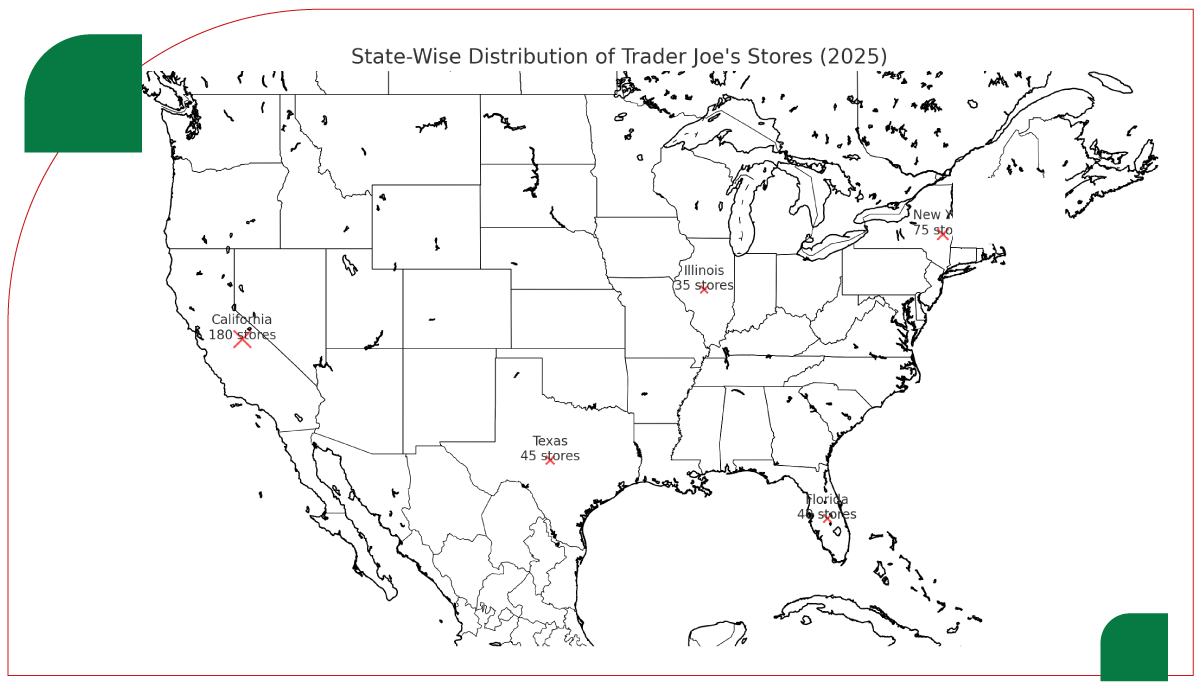

State-Wise Distribution of Trader Joe's Stores (2025)

| State |

Number of Stores |

% of Total Stores |

Key Cities Represented |

| California |

180 |

30% |

Los Angeles, San Francisco, San Diego |

| Texas |

45 |

7.5% |

Austin, Houston, Dallas |

| Florida |

40 |

6.7% |

Miami, Orlando |

| Illinois |

35 |

5.8% |

Chicago |

| Other States |

225 |

37.5% |

Various (Washington, Ohio, Pennsylvania) |

Key Observations

- California remains the dominant state with 30% of the total stores. Major cities like Los Angeles, San Francisco, and San Diego are home to multiple Trader Joe’s locations.

- New York follows with 12.5% of the store count, primarily in New York City and Long Island.

- Texas, Florida, and Illinois are also significant contributors to the store count, showcasing the company's expansion into southern and midwestern states.

The spread across various states indicates that Trader Joe's focuses on high-density urban areas to maximize reach and cater to a growing urban population.

Comparison of Trader Joe’s Store Growth from 2022 to 2025

In this section, we will present a comparison of the store growth from 2022 to 2025 by focusing on the growth rate, geographical spread, and market penetration. By analyzing the data through Trader Joe's Store Count Data Extraction USA 2025, we can identify key trends and areas of rapid expansion. The comparison will highlight the significant growth trajectory Trader Joe's has experienced, as well as its strategic decision-making in store placements. The analysis also considers the increasing importance of online grocery delivery, underscoring the role of Trader Joe's Grocery Delivery Scraping API Services in tracking the company’s market penetration in the e-commerce space. This comparison will provide a comprehensive understanding of Trader Joe’s growth, both online and offline.

Store Growth Comparison (2022-2025)

| Year |

Number of Stores |

Store Growth (%) |

Percentage Increase in New States |

| 2022 |

520 |

- |

- |

| 2023 |

550 |

5.77% |

8% |

| 2024 |

580 |

5.45% |

7% |

| 2025 |

600 |

3.45% |

6% |

Key Insights

- The growth percentage was highest between 2022 and 2023, showing a healthy increase of 5.77%.

- In 2025, the store growth rate is projected to slow down slightly, which can be attributed to market saturation and the increasing competition in urban areas.

- The percentage increase in the number of new states where Trader Joe’s is expanding has also decreased, reflecting more mature market expansion, as the company has already penetrated most major urban areas.

Store Expansion and Growth Strategies

Trader Joe’s growth strategy focuses on organic expansion, often targeting underserved urban and suburban markets. The company tends to open new stores in close proximity to existing ones, leveraging brand recognition and local market knowledge. Expansion is often planned in areas where there is a high demand for grocery delivery and pickup options, with the company gradually rolling out its online services in select locations. As part of this expansion, the company increasingly depends on Scrape Online Trader Joe's Grocery Delivery App Data to identify customer trends and ensure a seamless transition into the digital marketplace. The data gathered through this method, along with Trader Joe's Grocery Store Dataset, helps optimize the grocery chain's growth and delivery strategy. Additionally, Web Scraping Trader Joe's Supermarket Data enables the company to track real-time product availability and pricing, further refining its operations to meet consumer demand. This focus on digital infrastructure ensures that Trader Joe’s remains competitive in the rapidly growing e-commerce grocery sector.

Challenges and Opportunities

Challenges:

- Market Saturation: In many metropolitan areas, Trader Joe's has already captured a significant share of the market, which could make further expansion challenging.

- Competition: Trader Joe’s faces stiff competition from other grocery chains like Whole Foods, Walmart, and Costco, which offer similar products at competitive prices.

- Logistical Constraints As the store count increases, logistical challenges in distribution and inventory management become more complex.

Opportunities

- Expanding into Suburban Areas: While Trader Joe’s has a strong foothold in urban locations, suburban areas present an untapped opportunity for further growth. Utilizing Supermarket Grocery Data Scraping can help identify emerging locations with high growth potential.

- Online Growth: With increasing demand for online grocery shopping, expanding e-commerce capabilities could allow Trader Joe’s to tap into new consumer segments. By leveraging Grocery Pricing Data Intelligence , the company can tailor its online offerings to competitive pricing trends.

- Private Label Expansion: Trader Joe's’ success is largely driven by its private-label products. The expansion of this range could attract more customers and create a unique selling point, supported by analyzing Grocery Store Datasets to better understand consumer preferences and demands.

Conclusion

Trader Joe's continues to experience steady growth in the United States, with an estimated 600 stores expected by 2025. By leveraging e-commerce and expanding its private-label offerings, Trader Joe's can maintain its competitive edge in the retail grocery market. Grocery Delivery Scraping API Services will play a crucial role in gathering essential data on inventory and delivery trends.

Through web scraping, we were able to extract and analyze real-time data, which helped visualize the company's growth trajectory and geographical spread. Integrating tools like the Grocery Price Dashboard allows businesses continuous tracking of price changes across various regions.

In the coming years, businesses can enhance its market insights by utilizing a Grocery Price Tracking Dashboard to ensure they remain competitive while catering to the evolving demands of consumers.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Restaurant App Scraping service, and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.