Introduction

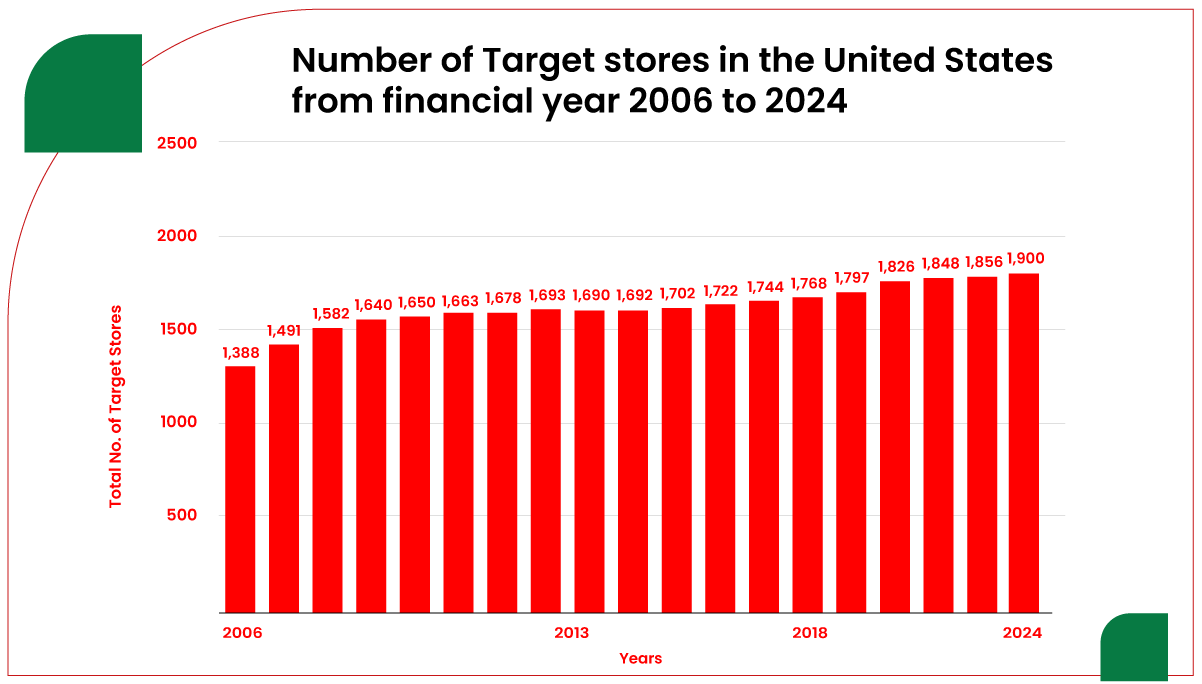

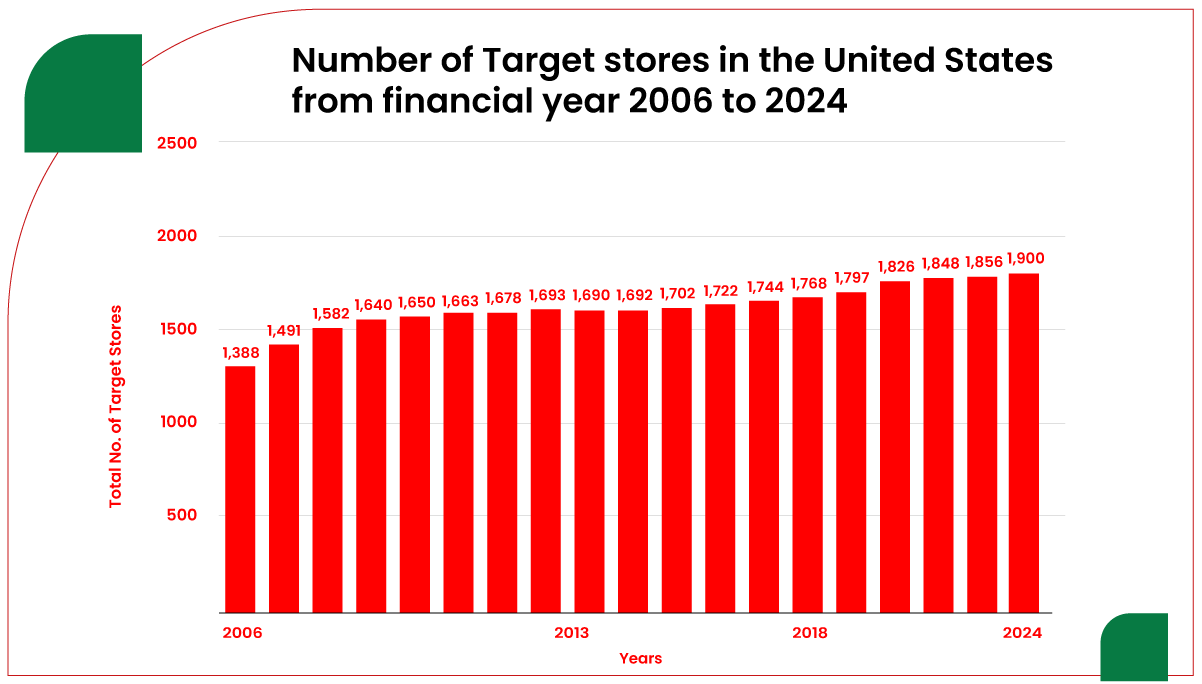

Target Corporation is one of the leading retail chains in the United States, offering products ranging from groceries to electronics. In 2024, Target will continue expanding stores nationwide, making them convenient and accessible to the customer. This report discusses Target Stores USA Data Extraction 2024 concerning the total number of stores and their geographic spread. Extract Target Store Count in the USA for 2024 to get insight into how the company is expanding and penetrating the markets. Scraping Target Store Locations Data in USA 2024 will also enable deeper regional expansion strategies and how the company places itself in terms of competitiveness in the various U.S. markets. With its reach across key regions and diversified retail offering, the current expansion of Target enables a more substantial presence to achieve data extraction, which becomes vital for assessing the latter's retail dominance in competitive prospects of growth into US retail.

Overview of Target Corporation

Founded in 1902 as a regional discount retailer and growing into a nationwide powerhouse, Target is known for its low prices across a wide range of product lines and for its strong branding. The company operates with physical stores and online interfaces, providing customers with smooth shopping experiences. Target diversified its retail business by expanding into food, apparel, home products, and personal care. With the constant demand for quicker and more convenient shopping, the company has gradually grown its store count across different states in the United States of America. The number of stores it operates is essential for understanding its market spread and growth plans. Data Extraction for the Target Store Count in USA 2024 will be essential to deepen the insight. With the use of tools to Scrape Target Store Data Across the USA for 2024, it will be easy to monitor the expansion and follow trends. The Number of Target Stores Data Extraction in the USA for 2024 is vital for knowing regional growth and market strategies.

Methodology

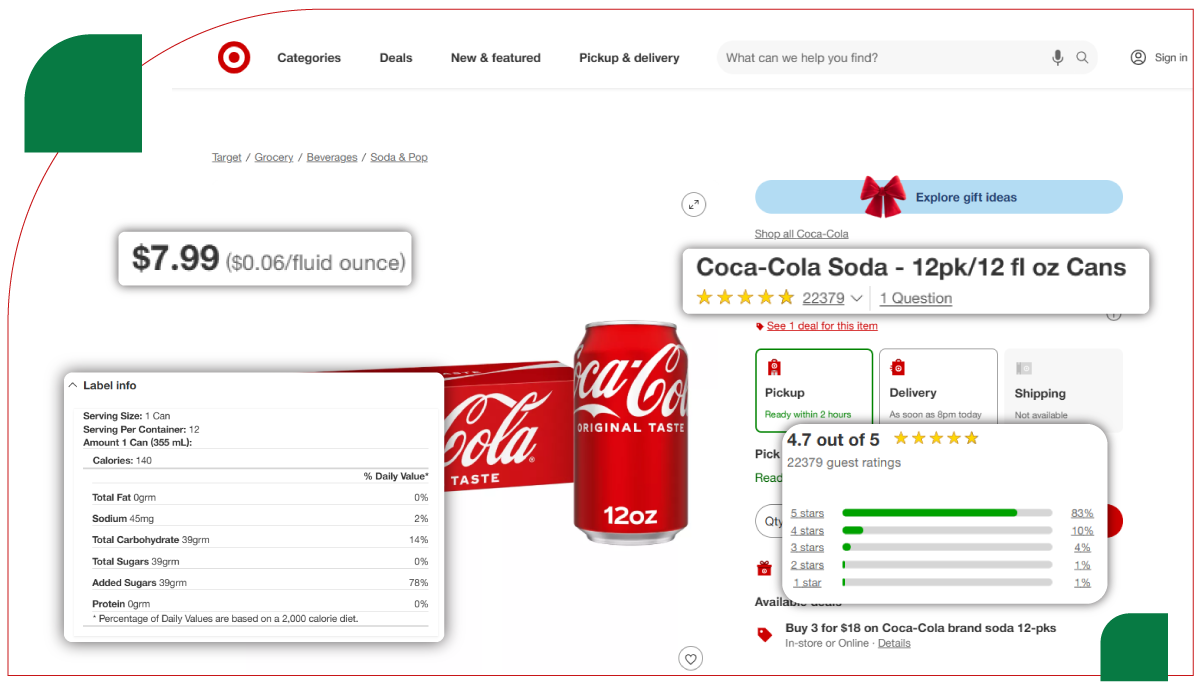

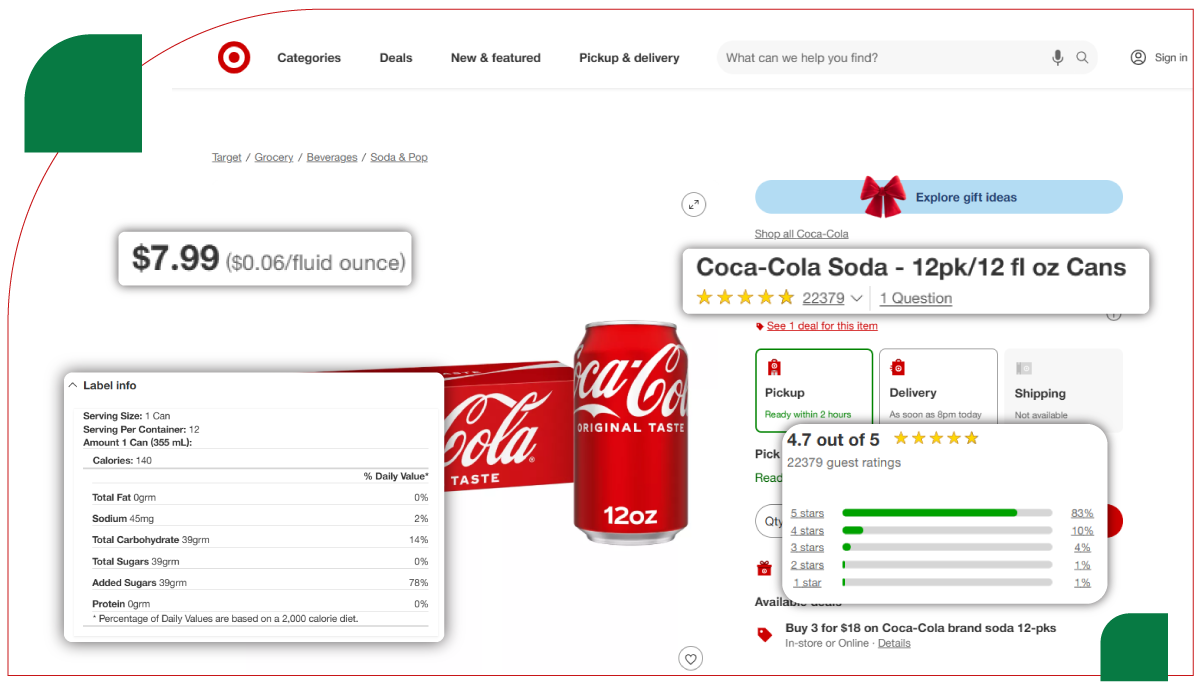

To determine the number of Target stores in the U.S. in 2024, data scraping techniques were used to extract publicly available information from Target's official website and other retail databases. Web scraping enabled store data collection, including location, type of store (e.g., SuperTarget or Target Express), and the geographical spread of these stores. The scraped data was then compared with previous data to measure growth or contraction in store numbers. Additionally, to gather Scrape Online Target Grocery Delivery App Data, advanced tools were used to access relevant data on product availability, pricing, and store locations. The results were essential for evaluating Target Grocery Data Scraping Services, which provide valuable insights into their delivery app operations. Furthermore, Grocery App Data Scraping Services helped track Target's grocery delivery trends, which is essential for understanding the impact of online shopping and delivery demand on the overall store count.

Target Store Numbers in 2024

As of 2024, Target operates over 1,900 stores across the United States. This figure includes a mix of full-size stores and smaller Target Express locations. Below is a breakdown of store types:

| Store Type |

Number of Stores in 2024 |

Percentage of Total |

| Full-size Target |

1,500 |

79% |

| SuperTarget |

150 |

8% |

| Target Express |

250 |

13% |

Target's full-size stores, which offer the most comprehensive range of products, constitute most of the chain's presence. SuperTarget stores, which focus more on groceries and other essentials, comprise about 8% of the total store count. The Target Express stores are smaller locations aimed at urban areas, accounting for 13% of the total. To gain a more detailed understanding of Target's supermarket offerings, it's essential to Extract Target Supermarket Data, which provides insights into the company's grocery offerings and store types across various regions. This data helps in analyzing store expansion, product availability, and consumer demand for supermarket product

Comparative Analysis of Target Stores (2023 vs. 2024)

Total Store Count Comparison

In 2023, Target operated 1,800 stores in the U.S., which increased to 1,900 stores in 2024. This indicates a growth of 5.56% in the number of stores over the year. Below is a table showing the breakdown of store growth:

| Store Type |

Number of Stores in 2023 |

Number of Stores in 2024 |

| Full-size Target |

1,450 |

1,500 |

| SuperTarget |

140 |

150 |

| Target Express |

210 |

250 |

From the table, it is clear that the largest growth occurred in the Target Express store category, which saw a 19.05% increase. This is in line with Target's strategy to expand its presence in urban areas where smaller retail spaces are needed. On the other hand, SuperTarget stores, which focus more on groceries, saw a 7.14% increase, while Full-size Target stores grew at a more modest rate of 3.45%.

Geographic Distribution and Regional Analysis

Target has a strong presence across the U.S., with particular concentration in states like California, Texas, and Florida. Here is a breakdown of store distribution across the major U.S. regions for 2024:

| Region |

Number of Target Stores (2024) |

Percentage of Total |

Region |

| West |

600 |

31.6% |

West |

| South |

700 |

36.8% |

South |

| Midwest |

400 |

21.1% |

Midwest |

| Northeast |

200 |

10.5% |

Northeast |

The South region has the most significant number of Target stores, making up 36.8% of the total. The West follows closely with 31.6% of stores, reflecting Target's strong presence in populous states like California and Texas. The Midwest and Northeast regions account for 21.1% and 10.5%, respectively. When comparing regional data from 2023, the distribution has remained relatively stable, with the South continuing to dominate store numbers. However, Target has focused its growth on areas with underserved retail populations, particularly in suburban areas and urban centers in the South and West regions.

To better understand regional trends and growth, Web Scraping Target Supermarket Data provides detailed insights into store locations, types, and product offerings across regions. Additionally, extracting a Target Grocery Store Dataset enables the analysis of grocery-related store operations, helping to track demand and store expansion in various geographic areas.

Store Expansion Strategies

Target's strategy for growth in 2024 revolves around several key factors:

- Urban Expansion: Target continues to expand its smaller-format Target Express stores in densely populated urban areas. These stores offer a curated selection of items and cater to consumers who need convenience and quick shopping experiences. By leveraging Target Grocery Delivery Scraping API Services, Target can enhance its offerings in urban areas by analyzing delivery trends and optimizing inventory.

- SuperTarget Growth: SuperTarget stores, offering larger grocery sections, are expanding to cater to the increasing demand for one-stop shopping experiences that combine groceries and other retail needs. The Web Scraping Quick Commerce Data helps Target monitor competitor pricing and understand consumer preferences, fueling the growth of SuperTarget locations.

- Online Integration: Target's integration of online shopping with its physical stores has led to a growth in foot traffic, especially with curbside pickup and in-store pickup options. This trend is expected to continue to drive demand for physical stores. By utilizing Grocery Delivery Scraping API Services, Target can track delivery patterns and enhance the online-to-offline shopping experience.

- Expansion into Suburban Areas: As Target seeks to increase its store count in suburban areas, it continues to open stores in regions previously underserved by large retailers. These new stores often feature more groceries, clothing, and household items. The Grocery Price Dashboard enables Target to track and compare prices across suburban locations, ensuring competitiveness and pricing consistency.

Market Challenges

Despite its growth, Target faces several challenges in maintaining its position in the retail market:

- Competition from E-commerce: With the rise of online shopping, especially from companies like Amazon and Walmart, Target must adapt its strategy to maintain relevance. Offering a seamless online-to-offline shopping experience is crucial. To remain competitive, Target can leverage Grocery Price Tracking Dashboard to monitor pricing strategies and adjust its offerings accordingly.

- Supply Chain Issues: Target has faced supply chain disruptions like many retailers, particularly during the COVID-19 pandemic. While supply chains have recovered mainly, Target must remain agile to prevent stock shortages and delays. Grocery Pricing Data Intelligence is key in analyzing and optimizing the supply chain to ensure product availability and competitive pricing.

- Rising Operational Costs: Target's profitability may be impacted as the cost of doing business rises, including labor and transportation costs. Strategic cost management will be vital to sustain its expansion. Using Supermarket Grocery Data Scraping, Target can assess cost trends and consumer preferences to optimize inventory management and reduce operational inefficiencies.

- Consumer Behavior: Changes in consumer preferences, such as a shift toward sustainability and local sourcing, may influence Target's store offerings and require further adaptation. By analyzing Grocery Store Datasets, Target can identify trends and adapt its offerings to meet evolving consumer demands, ensuring long-term relevance.

Conclusion

In 2024, Target continues to expand its store presence across the United States, focusing on both urban and suburban areas. The number of stores has increased by 5.56% compared to 2023, with the most significant growth occurring in Target Express locations. Regional distribution remains heavily concentrated in the South and West, with Target's growth strategy focusing on meeting the increasing demand for convenient, accessible retail experiences.

As Target adapts to changing market conditions and consumer preferences, it will face opportunities and challenges. However, its growth trajectory in 2024 indicates a strong position in the U.S. retail market, with the potential for further expansion in the coming years.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Restaurant App Scraping service, and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.