Introduction

The grocery retail industry in Michigan is growing significantly, with major grocery chains expanding to meet rising consumer demand. This report analyzes the 10 largest grocery chains in Michigan for 2025, focusing on store locations and comparing them with 2024 data. Scrape 10 Largest Grocery Chains Data in Michigan for 2025 to analyze store expansion trends and identify key regional shifts. In addition, our research uses Michigan Grocery Chain Locations Data Scraping for 2025 to analyze how retailers strategically position themselves in the state. This data-based approach helps uncover information about grocery chains' expansion strategies and regional market presence. Understanding these trends is essential for businesses, investors, and consumers seeking to stay updated on the shifting grocery landscape of Michigan. The findings in this report reveal critical insight into how the grocery chains of 2025 respond to market dynamics and consumer preferences.

Methodology

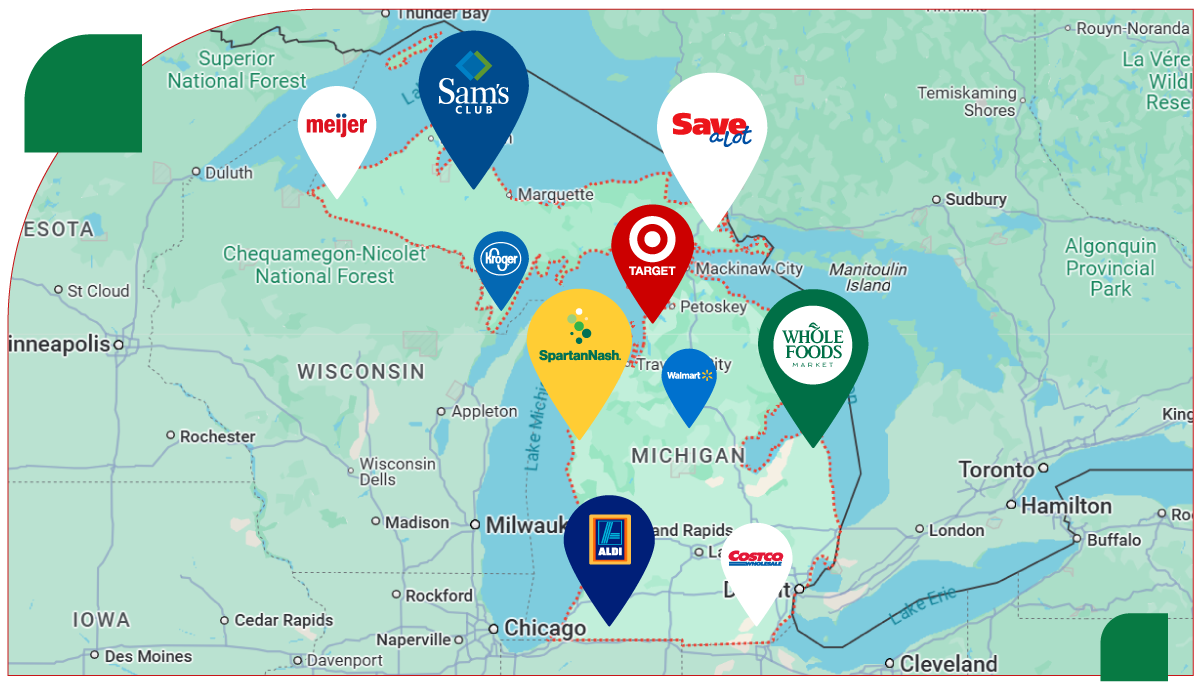

Information collection for this study was conducted through web scraping, thus gathering location data of stores from official sites, third-party business directories, and mapping services. The list of counts, location distribution, and year-over-year changes are added to the dataset. Using methods to Extract Michigan Grocery Store Data by Location for 2025, we could map the geographic expansion of grocery chains across all types of regions. This analysis shows how major grocery chains have expanded their presence across urban, suburban, and rural areas. In addition, Michigan Grocery Store Locations Data Extraction for 2025 allowed us to determine the key trends in store growth and regional shifts. The results prove the potency of Grocery Data Scraping Services in delivering insights into the evolving Michigan grocery retail landscape, enabling stakeholders to understand market dynamics and consumer preferences.

Largest Grocery Chains in Michigan (2025)

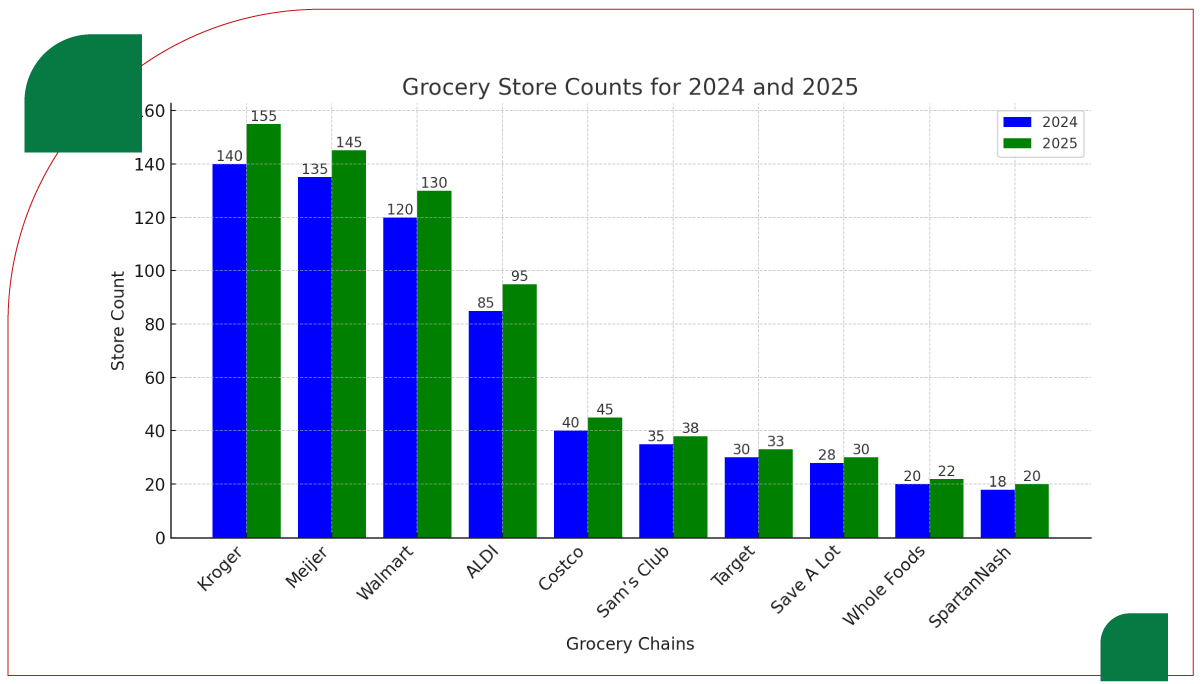

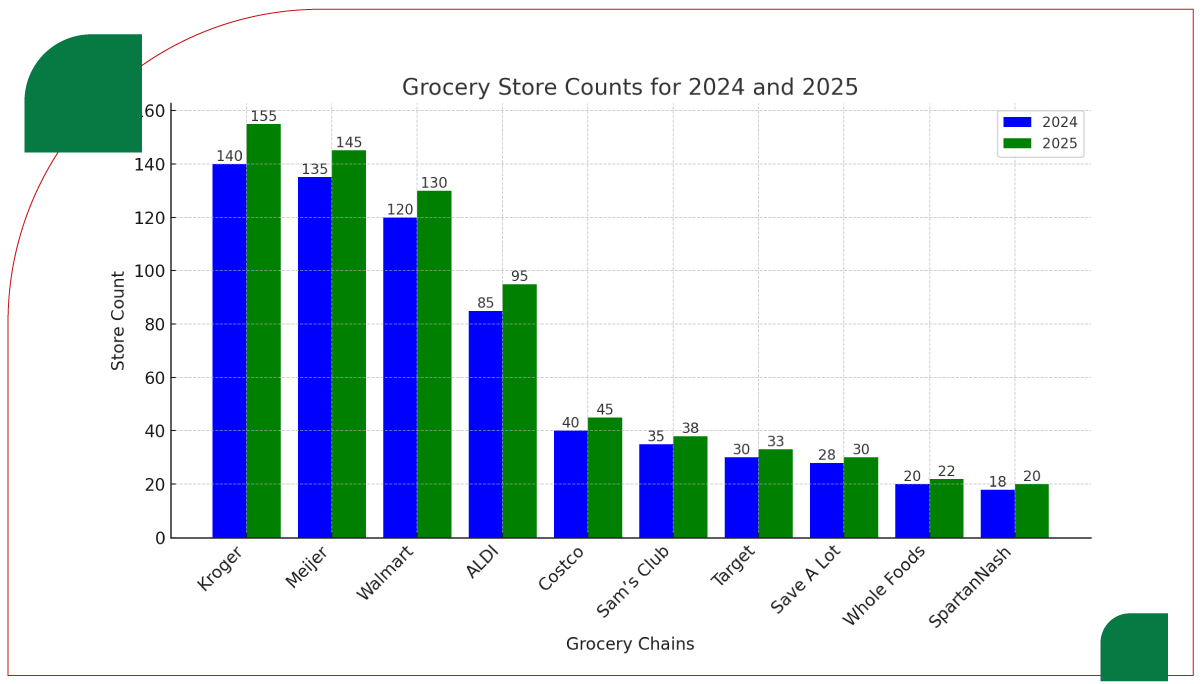

The table below presents the 10 largest grocery chains in Michigan, their store counts for 2025, and the percentage increase compared to 2024. This data was gathered using the Scrape Grocery Store Location Data in Michigan for 2025 method, which allowed for a comprehensive comparison of growth trends and store expansion across different regions. By analyzing these numbers, we can identify which chains are leading in market growth and how they have adjusted their strategies to meet rising consumer demand.

Table 1: Store Count Comparison of Top 10 Grocery Chains in Michigan (2024 vs. 2025)

| Rank |

Grocery Chain |

Store Count (2024) |

Store Count (2025) |

% Increase |

| 1 |

Kroger |

140 |

155 |

10.7% |

| 2 |

Meijer |

135 |

145 |

7.4% |

| 3 |

Walmart |

120 |

130 |

8.3% |

| 4 |

ALDI |

85 |

95 |

11.8% |

| 5 |

Costco |

40 |

45 |

12.5% |

| 6 |

Sam's Club |

35 |

38 |

8.6% |

| 7 |

Target |

30 |

33 |

10.0% |

| 8 |

Save A Lot |

28 |

30 |

7.1% |

| 9 |

Whole Foods |

20 |

22 |

10.0% |

| 10 |

SpartanNash |

18 |

20 |

11.1% |

Analysis of Grocery Chain Expansion

1. Growth Trends by Region

- Urban Areas: Chains such as Kroger, Meijer, and Walmart have aggressively expanded in densely populated cities like Detroit, Grand Rapids, and Ann Arbor. With a growing demand for grocery delivery and in-store shopping, these locations have seen the highest number of new store openings. This growth was tracked using Michigan Grocery Store Data Extraction Services, providing detailed insights into expansion patterns in urban areas.

- Suburban Growth: ALDI and Costco have increased their presence in suburban areas, catering to families seeking cost-effective shopping options. Their expansion has been notable in cities such as Novi, Troy, and Lansing, which were identified through Supermarket Locations Scraping in Michigan, revealing key trends in suburban store openings.

- Rural Expansion: Chains such as Save A Lot and SpartanNash have focused their expansion efforts on rural areas with lower competition, but demand for affordable groceries remains strong. Their store openings, particularly in northern Michigan and the Upper Peninsula, were analyzed using Web Scraping Michigan Grocery Chain Locations Data for 2025, highlighting growth in less densely populated regions.

2. Percentage Increase Analysis

- The highest percentage increase was seen in Costco (12.5%) and ALDI (11.8%), showing a strong push towards discount and bulk shopping trends. This shift can be tracked through Grocery App Data Scraping services , which help monitor changing consumer preferences.

- Kroger, the largest grocery chain in Michigan, added 15 new locations, marking a steady expansion of 10.7%. This growth aligns with broader trends identified through Web Scraping Quick Commerce Data , which reveals how significant chains are adapting to the rise of online shopping.

- SpartanNash and Whole Foods, though smaller in number, showed over 10% growth, indicating increasing competition in niche grocery markets. These insights were obtained using Grocery Delivery Scraping API Services , helping to analyze growth patterns in specific market segments.

3. Competitive Landscape

- Walmart and Meijer: Both retail giants, Walmart and Meijer, continue to be direct competitors in the grocery sector, with each company expanding its reach at a comparable pace. Walmart, known for its massive footprint and diverse product range, and Meijer, with its strong presence in the Midwest, are both ramping up their investments in new stores and digital services to cater to the growing demand for convenience and value.

- Discount grocery chains (ALDI and Save A Lot): Discount grocery chains, such as ALDI and Save A Lot, are increasingly appealing to price-sensitive shoppers. These stores have successfully captured a significant portion of the market by offering low-cost products, primarily through private-label brands, and by focusing on no-frills store formats that reduce overhead costs. Their business model aligns well with the financial pressures faced by many consumers, especially during economic uncertainty.

- Warehouse clubs (Costco and Sam’s Club): Warehouse clubs like Costco and Sam’s Club are placing more emphasis on boosting membership sign-ups, with a strategic focus on suburban locations. These stores have tailored their services to attract local communities with bulk-buying options, exclusive member deals, and an emphasis on high-quality goods at competitive prices. Their membership-based model allows them to offer lower prices on large quantities, making them particularly appealing to families and small businesses.

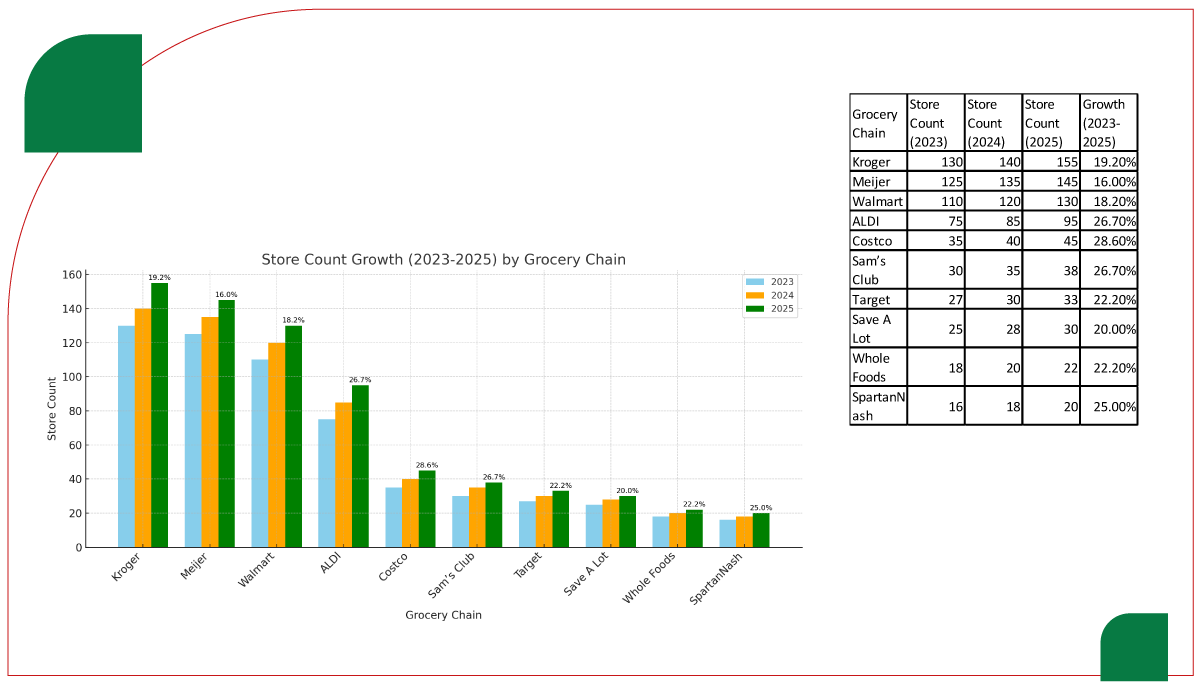

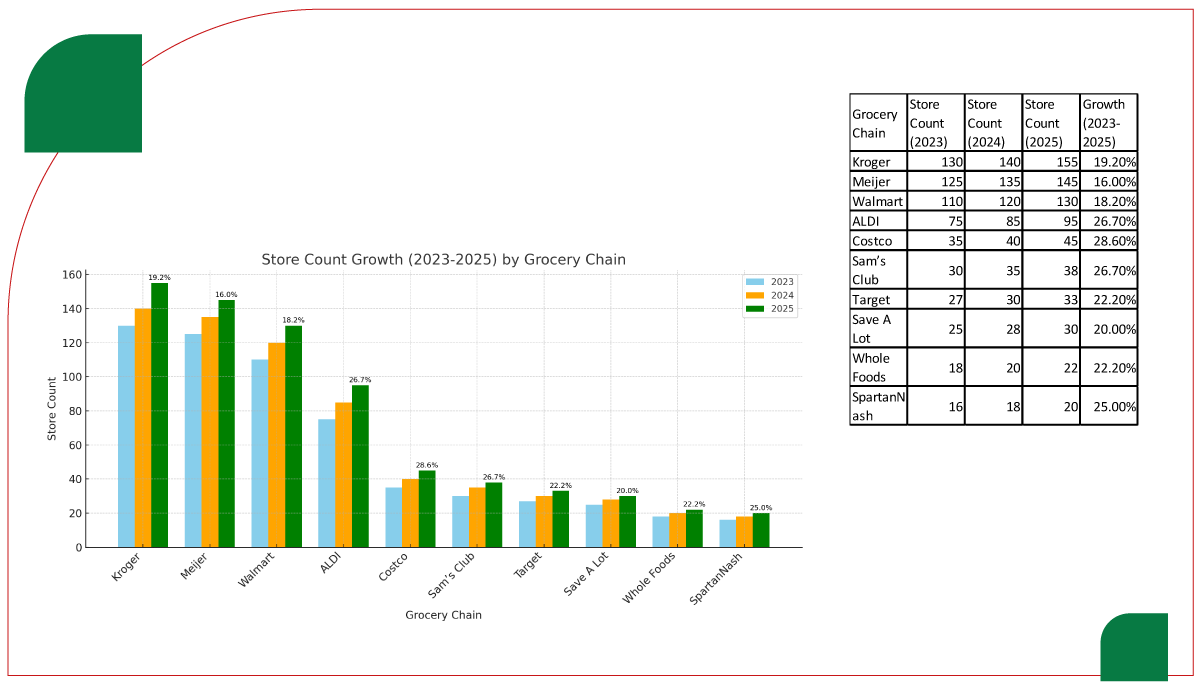

Year-over-Year Store Growth Analysis (2023-2025)

The table below showcases how these grocery chains have grown over the past two years, demonstrating a continuous increase in store locations. This growth data is further analyzed and visualized using a Grocery Price Dashboard , providing a comprehensive view of the trends in store expansion alongside pricing fluctuations.

Table 2: Year-over-Year Store Growth (2023-2025)

| Grocery Chain |

Store Count (2023) |

Store Count (2024) |

Store Count (2025) |

Growth (2023-2025) |

| Kroger |

130 |

140 |

155 |

19.2% |

| Meijer |

125 |

135 |

145 |

16.0% |

| Walmart |

110 |

120 |

130 |

18.2% |

| ALDI |

75 |

85 |

95 |

26.7% |

| Costco |

35 |

40 |

45 |

28.6% |

| Sam's Club |

30 |

35 |

38 |

26.7% |

| Target |

27 |

30 |

33 |

22.2% |

| Save A Lot |

25 |

28 |

30 |

20.0% |

| Whole Foods |

18 |

20 |

22 |

22.2% |

| SpartanNash |

16 |

18 |

20 |

25.0% |

Key Findings from Growth Trends

• Between 2023 and 2025, ALDI, Costco, and Sam’s Club showed the highest percentage growth, capitalizing on budget-friendly and bulk purchasing trends.

• Traditional chains like Kroger and Meijer continued expanding but at a slower pace than discount grocery chains.

• The grocery market in Michigan is becoming increasingly competitive, with major players increasing their store presence in urban and rural areas.

Conclusion

The grocery retail sector in Michigan is witnessing continuous expansion, with significant chains adding new locations to cater to growing consumer demand. Our analysis shows that between 2024 and 2025, the total number of stores among the top 10 grocery chains increased significantly, with an average growth rate of 10%. The rise in store openings is driven by changing consumer preferences, increased demand for grocery delivery, and the need for cost-effective shopping options. As we move into 2025, the competition among grocery chains will likely intensify, with further expansion expected in suburban and rural markets. Insights into these trends are supported by tools like the Grocery Price Tracking Dashboard , which monitors pricing shifts across chains, and Grocery Pricing Data Intelligence , providing detailed analysis of cost dynamics. Additionally, Supermarket Grocery Data Scraping allows for extracting key metrics, helping businesses understand competitive positioning and consumer demand in real time.

Future Outlook

• Increased Expansion: The trend of increasing store counts is expected to continue, with grocery chains focusing on omnichannel strategies that combine physical store expansion with online grocery delivery services.

• Technology Integration: Chains may leverage AI-driven analytics for better store placement, demand forecasting, and customer engagement.

• Sustainability and Local Sourcing: More stores will likely incorporate sustainability initiatives and source local products to meet consumer expectations.

The insights from this report highlight the importance of data-driven decision-making for grocery retailers, ensuring they can adapt to the evolving market landscape in Michigan. Staying competitive will require strategic expansion and innovative customer engagement strategies as store numbers continue to rise. Utilizing Grocery Store Datasets is crucial for retailers to monitor trends, optimize store placements, and tailor their offerings to meet changing consumer demands. Data-driven approaches enable businesses to make informed decisions that support long-term growth and market dominance.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.