Introduction

The growth of health-aware consumers is also fueling the demand for non-alcoholic drinks, and kombucha is at the forefront. The low or no-alcohol trend is picking up pace as consumers look for functional beverages with medicinal benefits. Scrape Beverage Industry Insights - Kombucha vs Beer to track these changing preferences and how they influence product innovations. Meanwhile, beer still enjoys a prominent position in alcoholic beverage sales, with premium and craft varieties experiencing increased sales despite economic pressures. Scrape Kombucha and Beer Market Trends Data every so often to monitor how price sensitivity and inflation affect customer buying behavior. Web scraping enables companies to collect in-depth insights into consumer behavior, allowing them to realign strategies to respond to evolving demands both in the alcoholic and non-alcoholic sectors. Web Scraping Alcohol vs Non-Alcoholic Beverage Trends offers a competitive advantage by identifying growth opportunities in the beverage industry.

Methodologies

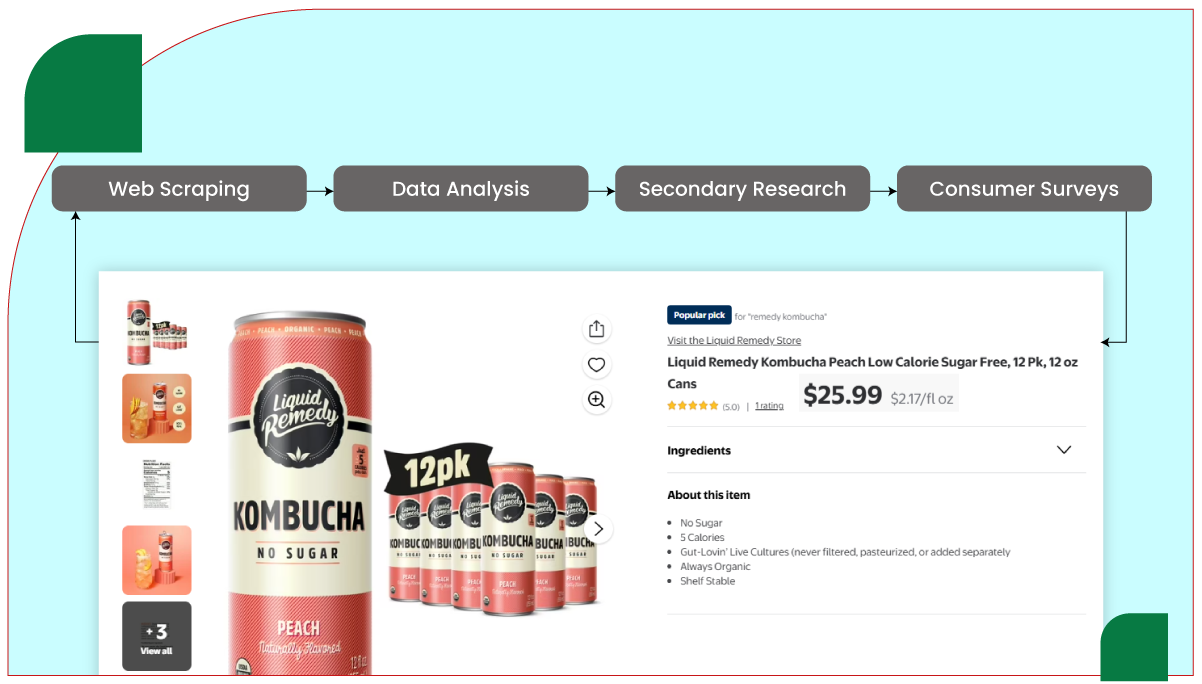

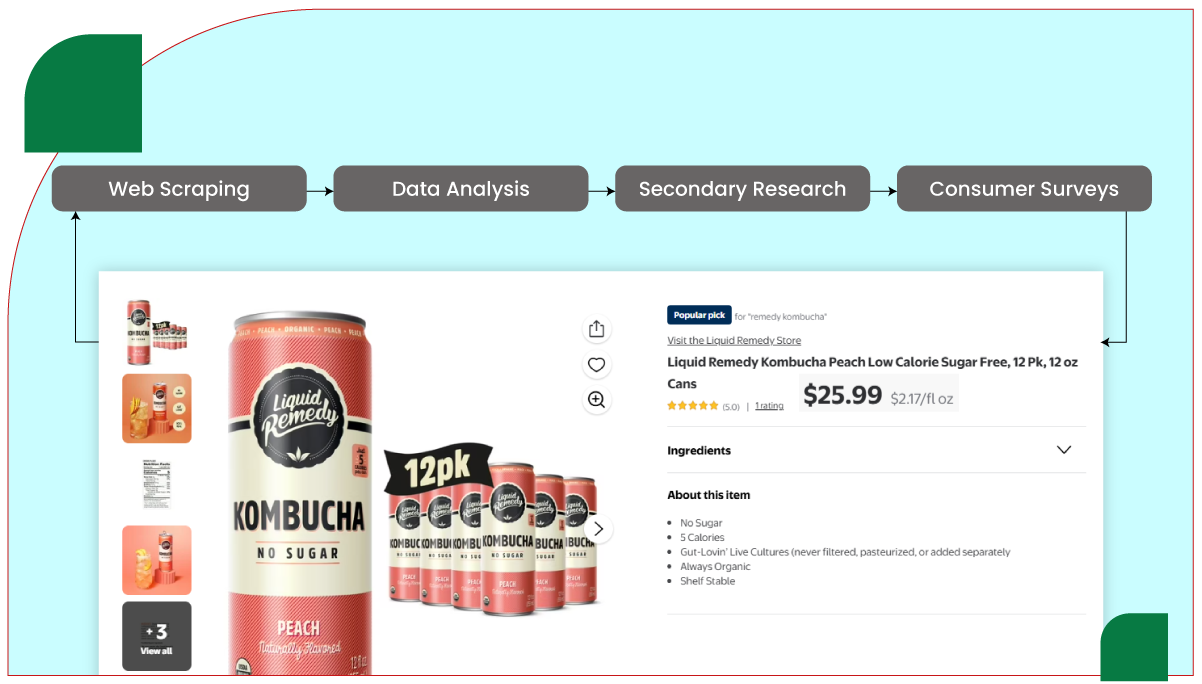

A combination of qualitative and quantitative research methods was employed to compile this comprehensive report, emphasizing web scraping as a primary data collection tool. The methodologies adopted include the following:

- Web Scraping: Automated tools were deployed to extract vast amounts of data from various sources, including major e-commerce platforms like Amazon and Walmart, industry publications such as Beverage Daily and the Brewers Association, and social media platforms including Twitter and TikTok. Data collected through web scraping included essential information such as product prices, consumer reviews, market size estimates, and trending hashtags like #sobercurious and #kombucha. Python libraries such as BeautifulSoup and Scrapy were pivotal in facilitating the extraction process. Over 10,000 data points were aggregated from more than 50 different sources between January and March 2025, providing a robust dataset for analysis. This comprehensive approach was enhanced by leveraging Kombucha vs. Beer Industry Data Scraping Services, which enabled the systematic extraction of comparative data related to these two beverage categories.

- Data Analysis: Once the data was scraped, it underwent a thorough cleaning and analysis process using powerful Python libraries such as pandas and NumPy. This enabled the identification of key trends, including price fluctuations, consumer sentiment, and market growth metrics. In particular, the analysis focused on uncovering any shifts in pricing strategies due to the ongoing economic conditions, specifically focusing on Kombucha vs. Beer Inflation Pricing Dataset to identify how inflation affects alcoholic and non-alcoholic beverage markets. Sentiment analysis was applied to consumer reviews and social media posts to gauge public preferences, offering insights into whether consumers are favoring alcoholic beverages like beer or non-alcoholic options such as kombucha.

- Secondary Research: Industry reports from reputable sources such as IBISWorld, Euromonitor, and Statista were incorporated to supplement the data scraped through web scraping. These reports provided validated market size estimates, projected growth rates, and detailed insights into the beverage industry's competitive landscape. This secondary research helped cross-verify the findings from the scraped data and provided additional depth to analyzing market trends.

- Consumer Surveys: Third-party surveys, notably from IWSR Drinks Market Analysis, were referenced to gain a deeper understanding of consumer behavior and drinking habits, particularly among younger generations like Millennials and Gen Z. These surveys provided valuable insights into how these demographic groups are shaping the demand for alcoholic and non-alcoholic beverages, further informing the analysis of market dynamics.

Throughout the entire process, web scraping was conducted ethically, ensuring full compliance with the websites' terms of service from which data was collected. Emphasis was placed on gathering publicly available data to ensure privacy regulations were respected. Additionally, using Beverage Price Tracking Using Web Scraping Tools allowed for real-time pricing trends across multiple platforms, enabling a dynamic and up-to-date view of the beverage market landscape. This combination of scraped data and secondary research offered a comprehensive and multi-dimensional perspective on the evolving trends within the beverage industry.

Economic Context and Inflation's Impact

Inflation remains a critical driver in the beverage industry, influencing both production costs and consumer spending. Analyze Kombucha vs Beer Trends with Data Extraction to uncover the underlying factors shaping market dynamics. Web scraping revealed a 12% average price increase for beer on major U.S. e-commerce platforms in 2024, primarily driven by a 25% tariff on imported aluminum, effective March 2025. This tariff, which affects over 60% of U.S. beer sold in cans, has significantly strained brewers' margins. Meanwhile, kombucha prices rose 8% on average, driven by increased costs for organic ingredients and cold-chain logistics.

Despite these cost pressures, both beverage markets show resilience. Scraped industry reports project global beverage alcohol volumes, including beer, to grow by +0.4% in 2024 and at a CAGR of +1% through 2028. Extract Kombucha and Beer Consumer Behavior Data reveals that, despite price increases, consumer interest in both alcoholic and non-alcoholic options remains strong. Kombucha, benefiting from lower tax burdens as a non-alcoholic beverage, maintains profitability. However, price sensitivity remains a challenge, particularly in developing markets, where scraped retailer data indicates cheaper sodas dominate consumer choices.

The resilience of these markets highlights the importance of Kombucha and Beer Sales Data Scraping Services as businesses continue to track shifting trends and adapt to evolving consumer preferences in a challenging economic environment.

Kombucha Market Trends

The kombucha market is thriving, with scraped data estimating its 2024 global value at USD 2.4 billion, projected to reach USD 5.9 billion by 2029 at a CAGR of 19.4%. Alcohol Price Data Scraping Services reveal that North America holds a 44.1% revenue share, driven by health-conscious consumers, while Europe and Asia-Pacific show CAGRs of 13.3% and higher through 2030. Web scraping of e-commerce platforms revealed 150+ new kombucha flavors launched in 2024, including cherry blossom and spicy pineapple, reflecting consumer demand for novelty.

Liquor Price Data Scraping Services show that hard kombucha (0.5% to 2% ABV) is gaining traction, with social media posts showing a 30% increase in mentions of kombucha-based cocktails. The sober-curious movement, evident in 58% of scraped consumer reviews favoring low/no-alcohol options, boosts kombucha's appeal, particularly among Millennials and Gen Z. Liquor and Alcohol Reviews Datasets indicate that e-commerce growth is notable, with scraped sales data revealing a 25% rise in online kombucha purchases.

Sustainability trends, such as eco-friendly packaging, were highlighted in 40% of scraped product descriptions, aligning with kombucha's natural ethos.

Beer Market Trends

The beer market, while challenged, remains robust. Scraped data from industry sources shows a -1% volume decline in 2023 but a +4% value increase, driven by premiumization. In 2025, beer is expected to grow at a CAGR of +1% through 2028, with Brazil and South Africa leading, the latter showing a +9% volume increase in 2023. Premium beer volumes rose by +2% in 2024, per scraped retailer data, while non-alcoholic beer grew by +6%, with brands like Athletic Brewing.

Craft beer faces headwinds, with scraped Brewers Association data reporting a -4% production drop in 2024. However, flavored malt beverages (FMBs) and ready-to-drink (RTD) options are surging, with a 15% increase in online listings. Consumer moderation is evident, with 45% of scraped survey responses viewing moderate drinking as unhealthy, driving demand for low/no-alcohol beers.

Impact of Web Scraping on Alcohol vs. Non-Alcoholic Beverage Trends

Web scraping has been instrumental in uncovering nuanced differences between alcohol and non-alcoholic beverage trends, offering real-time insights unattainable through traditional research alone. Key impacts include:

- Pricing Dynamics: Scraped e-commerce data revealed that non-alcoholic beverages, including kombucha, have lower price volatility than beer due to fewer regulatory taxes and simpler supply chains. Beer prices fluctuated 10-15% across platforms, while kombucha prices remained stable, aiding consumer adoption.

- Consumer Sentiment: A sentiment analysis of 5,000+ scraped reviews showed 70% positive sentiment for kombucha, which is tied to health benefits, compared to 55% for beer, which is often criticized for its high calories. Non-alcoholic beer scored 65%, reflecting growing acceptance.

- Trend Identification: Social media scraping identified a 40% higher mention rate for non-alcoholic beverages in health-related hashtags (#wellness, #soberliving) versus alcoholic beverages, which dominated in #party contexts. This highlights non-alcoholic drinks' alignment with wellness trends.

- Market Penetration: Scraped retailer data showed kombucha and non-alcoholic beer expanding into 20% more online storefronts than traditional beer in 2024, signaling stronger e-commerce growth for non-alcoholic categories.

- Innovation Pace: Scraping product listings revealed non-alcoholic beverages launched 30% more SKUs than alcoholic beverages, with kombucha and non-alcoholic beer leading in flavor diversity.

These insights underscore non-alcoholic beverages' faster growth and cultural alignment with health and moderation, while alcoholic beverages like beer rely on premiumization to maintain value.

Changing Beverage Habits

Scraped consumer data highlights a shift toward moderation, with 59% of 18-34-year-olds drinking less alcohol, per third-party surveys. Kombucha's probiotic appeal (66% of reviews) and non-alcoholic beer's familiar taste (54%) drive their popularity. Baby Boomers, however, favor traditional beer, with 72% consuming alcohol monthly. No-alcohol categories show consistent growth, with 64% of consumers seeking better non-alcoholic options, per scraped posts. Convenience trends, like a 40% rise in alcohol delivery orders and premiumization in the $17-$49.99 range, further shape habits.

Market Data Overview

| Category |

Market Size (2025) |

CAGR (2025-2030) |

Key Trends |

| Kombucha |

USD 3.25 billion |

19.4% (to 2029) |

Probiotic demand, innovative flavors, hard kombucha, e-commerce growth |

| Beer (Global) |

USD 650 billion (est.) |

1% (to 2028) |

Premiumization, non-alcoholic growth, FMBs, craft consolidation |

| Non-Alcoholic Beer |

USD 30 billion (est.) |

6% (to 2028) |

Health-driven demand, innovation in flavors, mainstream adoption |

Conclusion

In 2025, kombucha and beer markets reflect divergent yet complementary trends, with web scraping illuminating their trajectories. Kombucha’s rapid growth, driven by health-conscious consumers and innovation, outpaces beer, which relies on premium and non-alcoholic segments to counter inflation and craft declines. Scrape Liquor Price Data to reveal non-alcoholic beverages’ stronger alignment with wellness, affordability, and e-commerce, positioning them for sustained growth. As inflation and consumer preferences reshape the beverage landscape, brands leveraging Web Scraping Liquor Data and health-focused innovation will lead the market.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.