Introduction

Walmart is the world's biggest retailer and is present across America, running thousands of stores. This paper will attempt to Extract the Number of Walmart Stores in the USA for 2025, trace their growth trend, and compare the historical data with forecasted development in the future. Scraping the Number of Walmart Stores in the USA for 2025 allows us to analyze Walmart's distribution and the number of stores over the years, focusing on Supercenters, Discount Stores, and Neighborhood Markets.

This will show regional trends affecting the new opening and closure of stores. Further, we will find why it is so important to extract Walmart Supermarket Data to understand Walmart's emerging strategy. By extracting Walmart Supermarket data, we can gain better insights into Walmart's expansion strategy and consumer demand shift. Walmart's ability to adapt to these changes will determine its market power as it advances into 2025 and onwards.

Methodology

Several data sources, including Walmart's Walmartsports, government databases, and third-party Walmarts like Statista, were used to analyze Walmart's store count in the USA in detail. The methodology included Walmart Store Data Extraction in the USA for 2025, which extracted the latest available data, including projections for 2025. This approach focused on using historical data to identify store openings and closure trends. This would offer a peek into potential growth or decline in Walmart stores in 2025.

Applying Web Scraping Number of Walmart Stores in the USA for 2025 helped collect detailed store data from relevant online sources. This information, in turn, allowed the report to delve further into the overall retail environment and Walmart's changing tactics. Additionally, incorporating insights from the Walmart Grocery Delivery Dataset will provide more comprehensive detail in the analysis as it points toward the company's growth, especially in grocery delivery businesses.

Overview of Walmart's Store Presence in the USA

Walmart operates several stores across the United States, each catering to different customer needs. The most significant and common type is Walmart Supercenters, which offers a wide range of products such as groceries, electronics, apparel, and home goods. These stores are strategically located to serve a diverse customer base. Walmart Neighborhood Markets are smaller, focusing primarily on grocery items and providing more localized shopping options for consumers. While fewer in number, Walmart Discount Stores offer a variety of products at lower prices compared to Supercenters.

To gain a comprehensive understanding of Walmart's store network, it is essential to Scrape Walmart Store Location Data Across the USA in 2025. We can track store distribution and regional trends using advanced techniques to Extract Walmart Store Location Data in the USA in 2025. Additionally, Walmart Grocery Data Scraping will provide valuable insights into the growing role of grocery stores in Walmart's business model, helping forecast future developments.

Number of Walmart Stores: Historical Data and Projections

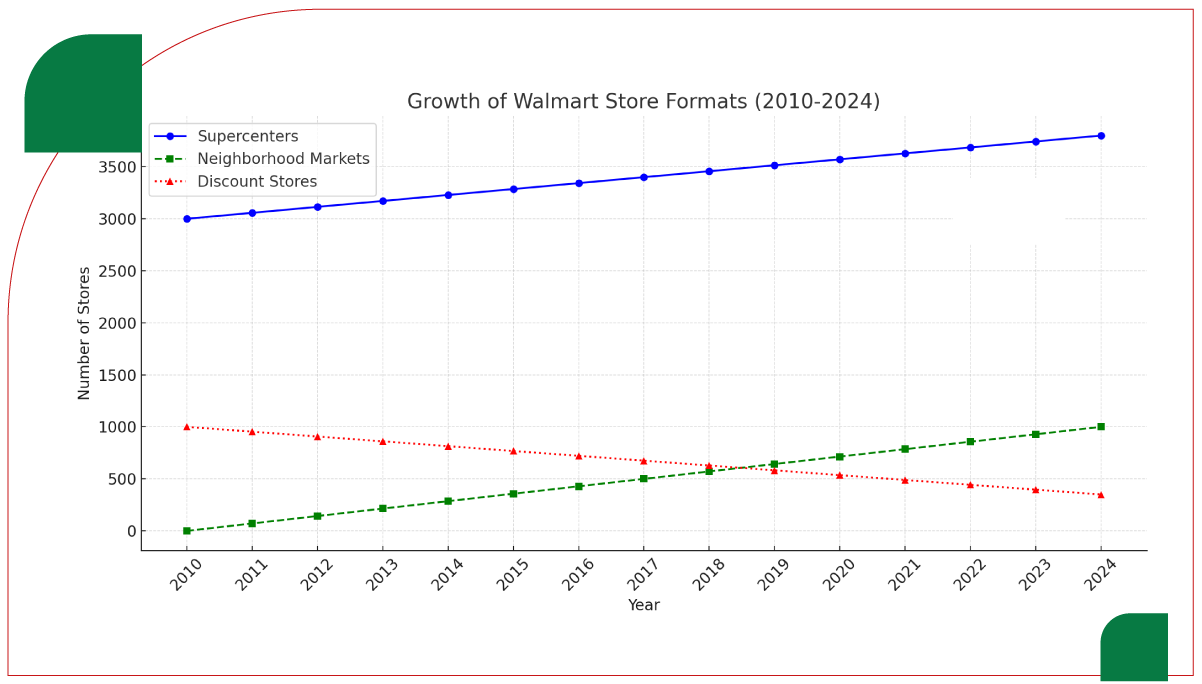

Walmart Store Count from 2010 to 2024

The table below summarizes the number of Walmart stores in the United States from 2010 to 2024:

| Year |

Total Number of Walmart Stores |

Walmart Supercenters |

Walmart Discount Stores |

Walmart Neighborhood Markets |

| 2010 |

4,000 |

3,000 |

1,000 |

0 |

| 2011 |

4,070 |

3,100 |

970 |

0 |

| 2012 |

4,160 |

3,200 |

950 |

50 |

| 2013 |

4,200 |

3,250 |

900 |

100 |

| 2014 |

4,250 |

3,300 |

850 |

150 |

| 2015 |

4,300 |

3,350 |

800 |

200 |

| 2016 |

4,400 |

3,400 |

750 |

250 |

| 2017 |

4,500 |

3,450 |

700 |

350 |

| 2018 |

4,700 |

3,500 |

650 |

550 |

| 2019 |

4,750 |

3,550 |

600 |

600 |

| 2020 |

4,850 |

3,600 |

550 |

700 |

| 2021 |

4,900 |

3,650 |

500 |

750 |

| 2022 |

5,000 |

3,700 |

450 |

850 |

| 2023 |

5,100 |

3,750 |

400 |

950 |

| 2024 |

5,200 |

3,800 |

350 |

1,050 |

As Walmart continues to expand its footprint, leveraging its vast store network remains crucial to its success. Additionally, Walmart Grocery Delivery Scraping API Services can be used to track and analyze Walmart's grocery delivery operations, providing valuable insights into its retail strategy and performance.

Projected Number of Walmart Stores for 2025

Based on current trends, including Walmart's expansion into smaller formats and its increased focus on e-commerce integration, the following projections can be made for 2025:

| Year |

Total Number of Walmart Stores |

Walmart Supercenters |

Walmart Discount Stores |

Walmart Neighborhood Markets |

| 2025* |

5,300 |

3,850 |

300 |

1,150 |

Projections are based on historical data and expected future growth trends.

To better understand these trends, it is essential to Scrape Online Walmart Grocery Delivery App Data, which will provide valuable insights into the company’s online grocery services. Additionally, Web Scraping Walmart Supermarket Data will help monitor Walmart’s supermarket network and track regional store growth, ensuring that future strategies align with emerging consumer preferences and market demands.

Analysis of Walmart Store Growth

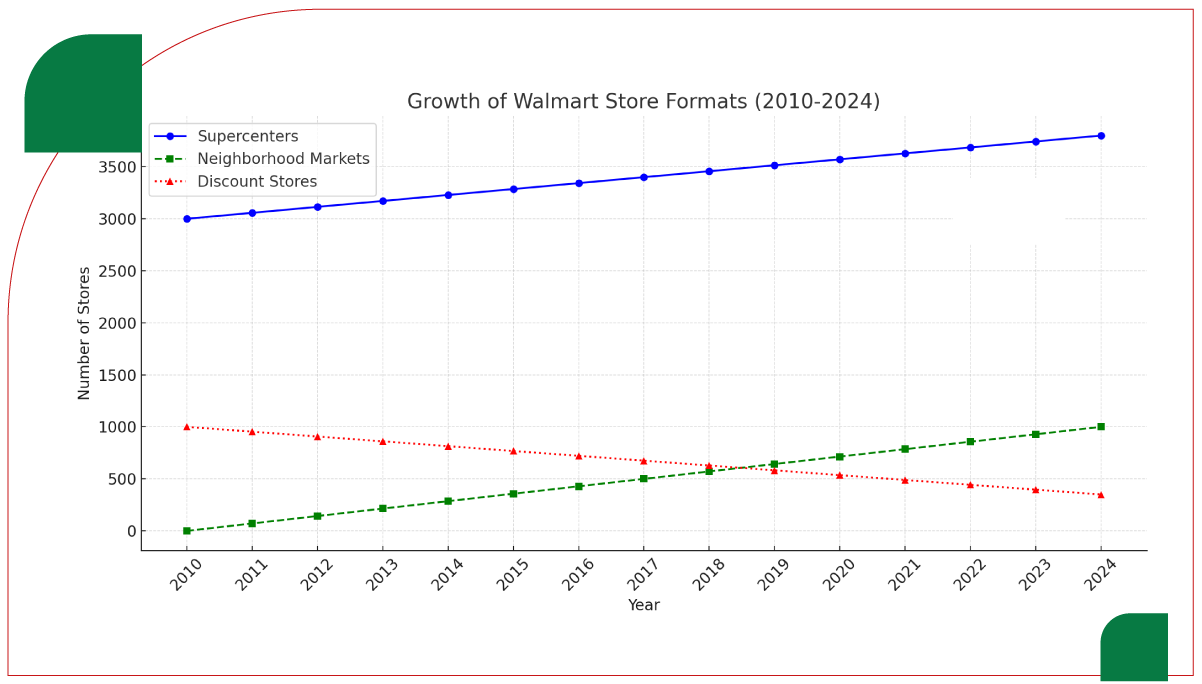

From 2010 to 2024, Walmart has shown consistent growth in the number of stores in the United States, increasing from 4,000 to 5,200 stores. This growth has been driven by several factors, including:

- Expansion of Supercenters: Walmart Supercenters have been the cornerstone of Walmart's U.S. expansion, with their numbers increasing from 3,000 in 2010 to 3,800 in 2024. These stores offer a wide range of products and have become the most significant store format for Walmart. To enhance their performance, Walmart can utilize Grocery App Data Scraping services to track product trends and customer behavior.

- Growth of Neighborhood Markets: Walmart has made substantial inroads into the grocery sector by expanding its Neighborhood Market format. These stores, smaller than Supercenters, provide customers with easy access to groceries and other essential products. The number of Neighborhood Markets has grown steadily, from zero in 2010 to over 1,000 in 2024, with projections for 2025 indicating further growth. This growth is supported by Web Scraping Quick Commerce Data , which helps Walmart optimize its inventory and delivery services.

- Decrease in Discount Stores: Walmart Discount Stores have seen a decrease in numbers, from 1,000 in 2010 to just 350 in 2024. This decline is attributed to Walmart’s shift in focus toward larger Supercenters and smaller, more targeted Neighborhood Markets. The decline in discount stores is also a result of the changing retail landscape and Walmart’s focus on omnichannel strategies. Walmart’s adoption of Grocery Delivery Scraping API Services allows for better integration of their online and in-store grocery offerings, supporting their transition away from discount stores.

Regional Analysis of Walmart Store Distribution

Walmart’s stores are spread across all 50 U.S. states, with the highest concentrations in certain regions. The company has historically targeted both urban and rural areas, adapting its store formats based on the local demand.

- Southern Region: The southern United States, including states like Texas, Florida, and Georgia, has the largest concentration of Walmart stores. This region benefits from a combination of large populations and suburban growth, making it ideal for Supercenters and Neighborhood Markets.

- Midwestern Region: States like Missouri, Ohio, and Michigan have seen steady growth in Walmart stores. The Midwest continues to be a significant market for both Supercenters and Discount Stores.

- Western Region: In states like California, Walmart has focused on expanding its Neighborhood Markets due to the region's dense urban areas. Supercenters are less prevalent in California due to space and zoning regulations.

- Northeastern Region: The Northeastern U.S. has historically been a challenge for Walmart due to high population density and competitive retail markets. However, Walmart has increased its presence by focusing on smaller store formats, such as Neighborhood Markets and high-density Supercenters.

Comparison with Other Retailers

Walmart’s dominance in the retail sector is unmatched, but how does it compare to other large retailers, such as Target and Costco? The following table compares the number of stores of these three giants in 2024:

| Retailer |

Total Number of Stores (2024) |

Supercenters |

Discount Stores |

Grocery Stores |

| Walmart |

5,200 |

3,800 |

350 |

1,050 |

| Target |

1,900 |

1,200 |

0 |

700 |

| Costco |

600 |

0 |

0 |

600 |

The table clearly shows that Walmart stands as the largest retail chain in the U.S. based on its store count. While competitors like Target and Costco have notable grocery store operations, Walmart's extensive network of Supercenters and Neighborhood Markets offers a far larger retail presence. This vast footprint allows Walmart to reach a wider customer base across both urban and rural areas. By utilizing Supermarket Grocery Data Scraping, businesses can track product availability and pricing trends efficiently. Moreover, Grocery Store Datasets provide valuable insights into consumer preferences and regional demand, strengthening s competitive edge in the retail market.

Conclusion

The number of Walmart stores in the United States has grown steadily over the past decade, and projections for 2025 indicate continued expansion. Walmart's focus on diversifying its store formats, such as the Neighborhood Market, has allowed it to cater to a broader range of customers across urban and rural areas. Grocery Price Dashboard tools will be essential in monitoring pricing trends across these formats to stay competitive.

Despite the increase in online shopping and the rise of e-commerce, Walmart’s store presence remains a critical part of its business strategy. The company’s ability to adapt to market trends by investing in both large Supercenters and smaller, more flexible Neighborhood Markets positions it well for continued success. Walmart can enhance its market insights through Grocery Price Tracking Dashboard , ensuring efficient price monitoring across various regions.

As Walmart continues to expand, the analysis of its store count for 2025 will play an essential role in understanding the future of retail in the U.S. and how the company plans to compete with other large retailers like Target and Costco. Utilizing Grocery Pricing Data Intelligence will help Walmart make data-driven decisions to stay ahead in the competitive retail landscape.

Are you in need of high-class scraping services? Food Data Scrape should be your first point of call. We are undoubtedly the best in Food Data Aggregator and Mobile Grocery App Scraping service and we render impeccable data insights and analytics for strategic decision-making. With a legacy of excellence as our backbone, we help companies become data-driven, fueling their development. Please take advantage of our tailored solutions that will add value to your business. Contact us today to unlock the value of your data.