Introduction

Tim Hortons, a well-known Canadian fast-food chain famous for its coffee and doughnuts, has expanded into the U.S., though its presence remains smaller than in Canada. This report aims to Extract the Number of Tim Hortons Restaurant Locations in the USA and analyze their distribution across different states. By leveraging data collection techniques, we can Scrape the Number of Tim Hortons Restaurants in the USA and identify key regional trends. The report also provides insights into the brand’s growth strategy and competitive positioning in the U.S. market. Furthermore, Web Scraping Tim Hortons Locations Data in the USA enables a comparative analysis of key locations, highlighting market penetration and future expansion opportunities. Two tables included in this report present essential data on the number of locations and their geographical concentration. Understanding these trends helps assess Tim Hortons’ impact on the U.S. fast-food landscape and potential areas for expansion.

Methodology

To conduct Data Extraction for Tim Hortons Restaurant Count in the USA, data was gathered from official sources, including Tim Hortons’ website, franchise reports, and publicly available business directories. Advanced techniques were used to Extract Tim Hortons Store Count in the United States, ensuring accuracy in identifying each location. Web scraping and API integration were crucial in compiling a comprehensive dataset. The collected data was then categorized by state and city to Extract the Number of Tim Hortons Stores Across the USA, providing valuable insights into geographic distribution. This analysis helps understand market penetration, regional demand, and potential areas for expansion. By leveraging these data extraction methods, businesses and analysts can track Tim Hortons’ growth patterns in the U.S. and evaluate competitive positioning in the fast-food sector. This report also highlights key findings, describing Tim Hortons’ current footprint across different states.

Total Number of Tim Hortons Locations in the USA

According to the latest data, Tim Hortons operates around 600 locations in the United States. Most of these restaurants are concentrated in states near the Canadian border, particularly in the Midwest and Northeast regions. Businesses looking to Scrape Tim Hortons Restaurant Data Across the USA can analyze location trends and market expansion. Additionally, companies can Extract Tim Hortons Food Delivery Data to understand delivery availability and customer demand in various regions. This data is valuable for assessing Tim Hortons’ footprint in the U.S. and identifying growth opportunities in the competitive fast-food industry.

Location Distribution by State

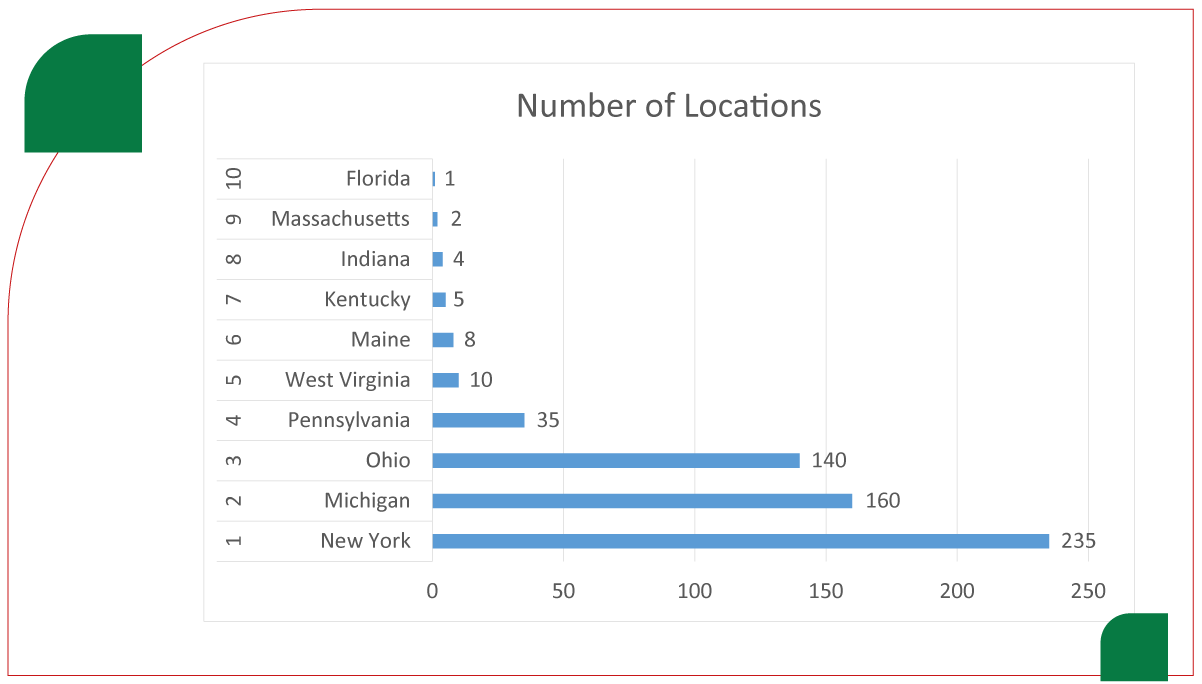

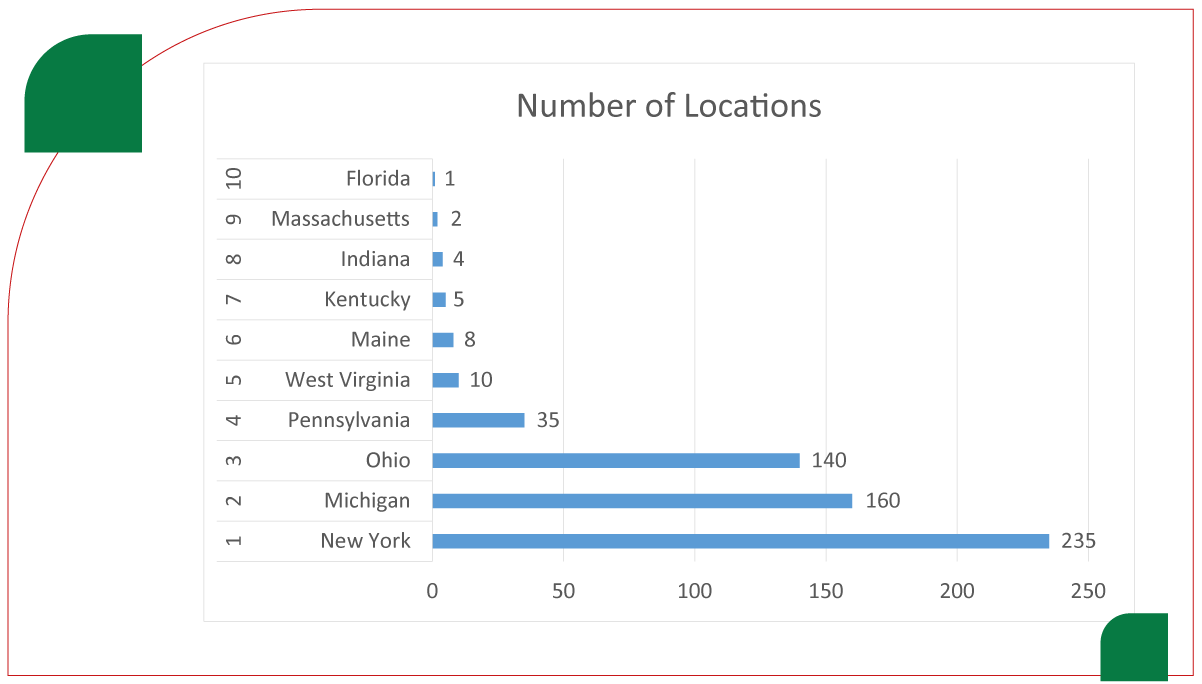

Table 1: Tim Hortons Locations by State

| Rank |

State |

Number of Locations |

| 1 |

New York |

235 |

| 2 |

Michigan |

160 |

| 3 |

Ohio |

140 |

| 4 |

Pennsylvania |

35 |

| 5 |

West Virginia |

10 |

| 6 |

Maine |

8 |

| 7 |

Kentucky |

5 |

| 8 |

Indiana |

4 |

| 9 |

Massachusetts |

2 |

| 10 |

Florida |

1 |

Key Insights from Location Distribution

- New York and Michigan lead the market: With a combined total of nearly 400 locations, these states serve as the primary hubs for Tim Hortons in the USA.

- Presence in Ohio: Ohio has a significant presence, particularly in cities like Columbus and Cleveland, making it an important market.

- Minimal Southern and Western Expansion: The brand has yet to establish a strong presence in the southern and western states, with only one location recorded in Florida.

City-Wise Distribution and Market Penetration

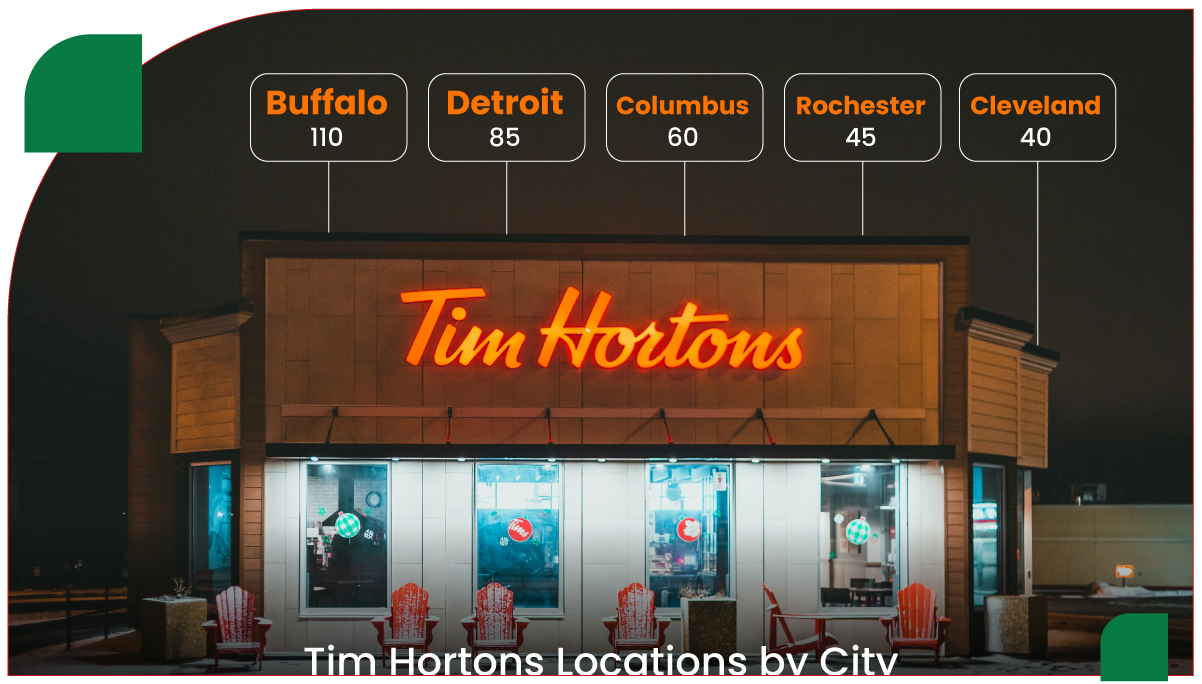

Examining city-wise distribution provides insights into Tim Hortons' urban and suburban preferences. Businesses can leverage Tim Hortons Food Delivery Scraping API Services to analyze restaurant density and customer demand across various locations. The following table highlights the top five U.S. cities with the highest number of Tim Hortons locations. Analysts can track regional trends, delivery availability, and expansion opportunities by utilizing Web Scraping Tim Hortons Food Delivery Data . This data helps businesses and researchers understand Tim Hortons’ market presence, enabling better decision-making regarding store placement and food delivery strategies in the competitive U.S. fast-food industry.

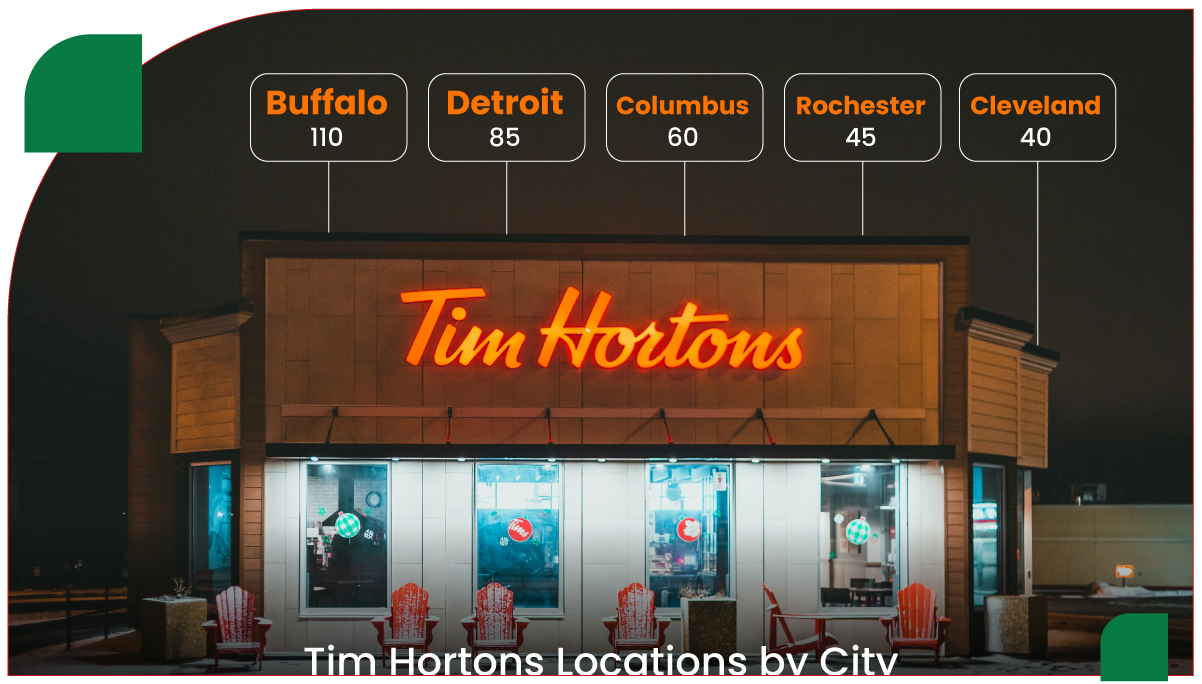

Table 2: Tim Hortons Locations by City

| Rank |

City |

State |

Number of Locations |

| 1 |

Buffalo |

New York |

110 |

| 2 |

Detroit |

Michigan |

85 |

| 3 |

Columbus |

Ohio |

60 |

| 4 |

Rochester |

New York |

45 |

| 5 |

Cleveland |

Ohio |

40 |

Comparative Analysis of Key Locations

1. Buffalo, NY vs. Detroit, MI

- Buffalo has the highest number of locations due to its proximity to Canada, making it a familiar brand for locals and tourists.

- Detroit also has a strong presence, catering to a large population of coffee consumers and benefiting from its location near the Canadian border.

2. Columbus, OH vs. Cleveland, OH

- Columbus shows significant growth potential, with increasing franchise openings in suburban areas.

- Cleveland has a steady presence, with locations concentrated in both urban and suburban areas.

3. Emerging Markets: Florida and Massachusetts

- Florida has only one location, indicating untapped market potential.

- Massachusetts has two locations, which suggests minimal brand recognition in the region.

Challenges and Growth Opportunities

Challenges

- Brand Recognition: Unlike in Canada, Tim Hortons faces intense competition in the U.S. from established coffee chains like Starbucks and Dunkin' Donuts. Gaining market share requires targeted marketing and localized strategies. Utilizing Restaurant Menu Data Scraping can help analyze competitor offerings and optimize Tim Hortons' product lineup.

- Regional Preferences: American consumers prefer larger coffee sizes, premium blends, and diverse menu options. Adapting to these preferences is crucial for success. Leveraging Food Delivery Scraping API Services can provide insights into trending products and customer demands.

- Operational Costs: Expanding into new states requires significant logistics, supply chain management, and advertising investments. Businesses can use Food Delivery Intelligence Services to assess potential locations, optimize distribution networks, and improve profitability.

Growth Opportunities

- Targeting Southern States: Expanding into high-population states like Texas, Georgia, and Florida presents a significant opportunity to increase brand awareness. These regions have a growing demand for coffee and breakfast options. Utilizing Restaurant Data Intelligence Services can help identify ideal locations based on consumer demographics, foot traffic, and competitor analysis.

- Franchise Expansion: Attractive franchise opportunities can encourage entrepreneurs and accelerate Tim Hortons' growth in the U.S. market. A strategic approach to franchising, supported by market data and operational insights, can drive long-term success.

- Digital Growth: Investing in mobile ordering, loyalty programs, and third-party delivery services can improve customer engagement and convenience. Integrating a Food Price Dashboard can help Tim Hortons optimize pricing strategies, monitor regional variations, and stay competitive in the fast-food industry.

Conclusion

Tim Hortons' presence in the United States is mainly concentrated in northern states, with New York and Michigan having the most locations. Cities like Buffalo and Detroit act as central hubs, while growth in southern and western regions remains slow. Tim Hortons Food Delivery Datasets can provide valuable insights into these geographic trends.

Despite facing competition, the brand has opportunities for expansion through strategic franchising and digital transformation. By utilizing Food Delivery Data Scraping Services , businesses can analyze consumer behavior and market potential.

Leveraging Web Scraping Food Delivery Data will help businesses refine their strategies and strengthen their position in the U.S. market.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.