Introduction

The U.S. coffee market is dominated by two giants: Dunkin' and Starbucks. Both companies enjoy robust customer loyalty, but both operate differently. Starbucks operates in a premium style, focusing on atmosphere and downtown accessibility, while Dunkin' excels due to its prices and grab-and-go appeal. One of their main success secrets is store location strategy, making it crucial to Extract Coffee Shop Location Data US: Dunkin' vs. Starbucks.

This report analyzes Dunkin' and Starbucks's geographical presence in cities and states, analyzing store density, per capita income effect, andregional tastes. With Web Scraping Starbucks vs. Dunkin' Store Locations Data US, companies can unlock insights into growth prospects, consumerdemographics, and demand.

In addition, Scraping Starbucks and Dunkin' Locations Data From the US reveals how location affects foot traffic, brand positioning, and potential revenue. Extract Starbucks and Dunkin' Store Data in the US to assist retailers, investors, and analysts in comprehending competitive benefits and consumer behavior trends. Due to the intense competition in the coffee market, using accurate location data is significant to maximize business tactics, enhance market penetration, and recognize growth prospects in different regions in the United States.

City-Wise Spread: Where Dunkin' and Starbucks Dominate

Dunkin' and Starbucks follow distinct strategies for city selection and market saturation. Starbucks prioritizes high-footfall urban centers, focusing on major metros like New York City, Los Angeles, and Chicago. Meanwhile, Dunkin' dominates suburban and northeastern areas, with strongholds in cities like Boston, Philadelphia, and Providence.

Businesses can analyze store distribution patterns by leveraging Web Scraping Coffee Chain Location Trends in the US. Additionally, Extract Starbucks Food Delivery Data to provide insights into regional demand, helping brands refine their expansion strategies and optimize customer reach in competitive coffee markets across the United States.

Table 1 below presents the top five U.S. cities with the highest number of Dunkin’ and Starbucks locations:

| City |

Dunkin’ Stores |

Starbucks Stores |

| New York City |

200 |

350 |

| Boston |

180 |

110 |

| Chicago |

120 |

250 |

| Los Angeles |

50 |

300 |

| Philadelphia |

140 |

120 |

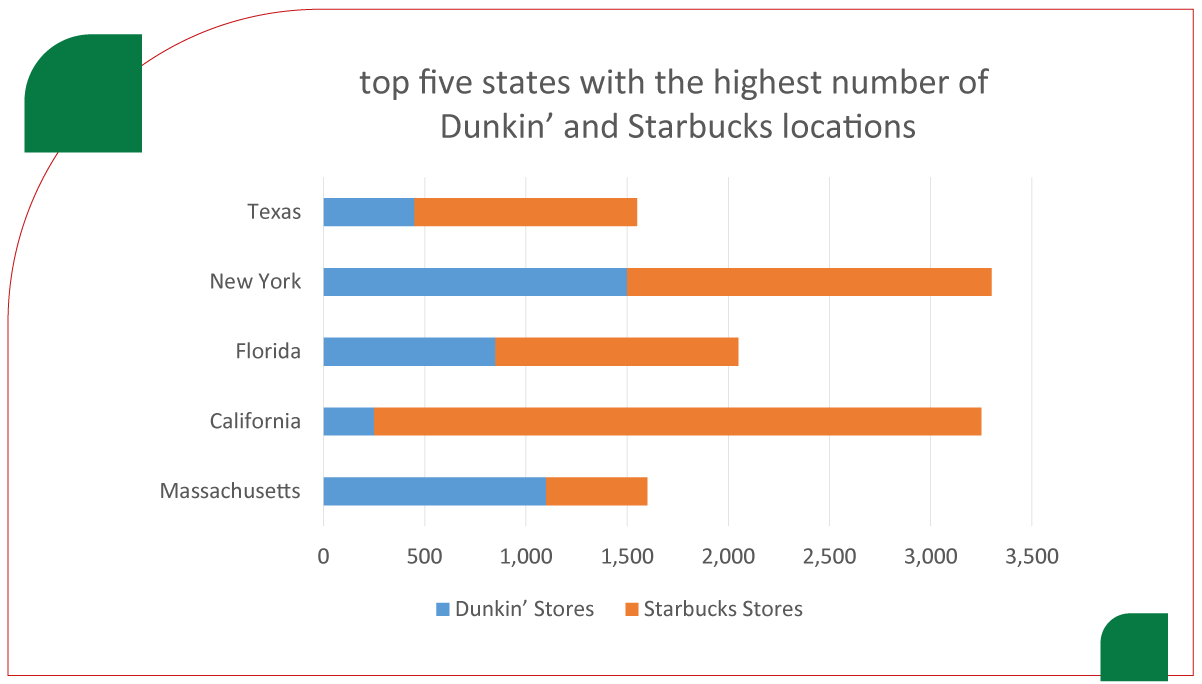

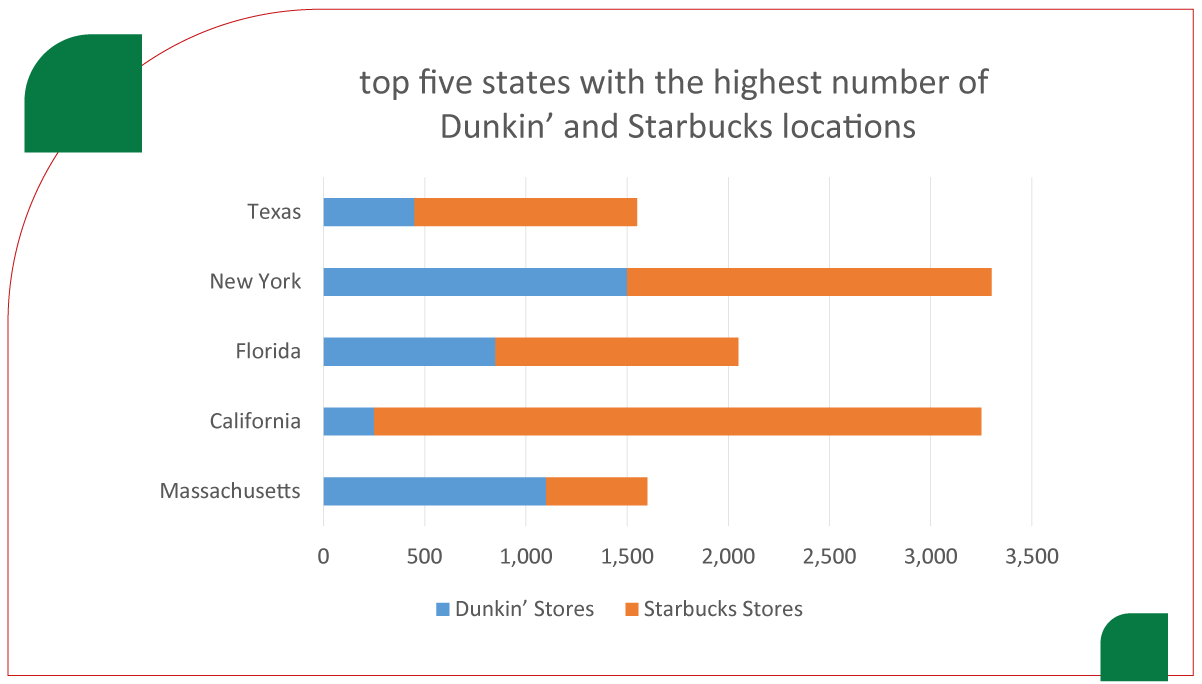

State-Level Distribution: Dunkin’ vs. Starbucks Across the U.S.

The geographical presence of Dunkin' and Starbucks differs across U.S. states. Dunkin' dominates the Northeastern corridor, particularly in Massachusetts, Rhode Island, and Connecticut, where it enjoys deep-rooted brand loyalty. Meanwhile, Starbucks has a stronger foothold on the West Coast and Pacific Northwest, with a high concentration in Washington, Oregon, and California.

Businesses can leverage Web Scraping Dunkin' Food Delivery Data to analyze regional demand. At the same time, Starbucks Food Delivery Scraping API Services provide insights into customer preferences, helping brands optimize store locations and expand food delivery services in key U.S. markets.

Table 2 provides a comparison of the top five states with the highest number of Dunkin’ and Starbucks locations:

| State |

Dunkin’ Stores |

Starbucks Stores |

| Massachusetts |

1,100 |

500 |

| California |

250 |

3,000 |

| Florida |

850 |

1,200 |

| New York |

1,500 |

1,800 |

| Texas |

450 |

1,100 |

Store Density and Local Affluence: Dunkin’ vs. Starbucks and Per Capita Income

One key factor influencing the location strategy of Dunkin' and Starbucks is per capita income. Starbucks focuses on affluent neighborhoods and business districts, leveraging premium pricing and an upscale customer experience. In contrast, Dunkin' thrives in middle-income, commuter-heavy areas, emphasizing affordability and quick service.

For example, Starbucks has a significant presence in high-income cities like San Francisco and Seattle due to its appeal to professionals and urban dwellers. Meanwhile, Dunkin' dominates in cities with a substantial working-class population, such as Newark and Buffalo, catering to budget-conscious consumers.

Using Dunkin' Food Delivery Scraping API Services, businesses can analyze store locations, income levels, and customer preferences. Additionally, Web Scraping Food Delivery Data provides insights into regional demand for coffee and quick-service food options.

Understanding Restaurant Menu Data Scraping allows businesses to assess pricing strategies and menu offerings tailored to specific demographics. Furthermore, leveraging Food Delivery Scraping API Services helps brands optimize their digital presence, ensuring their products reach the right audience. By analyzing these factors, retailers can make data-driven decisions to maximize revenue and enhance market positioning across various U.S. regions.

The Role of Location Intelligence in Retail Strategy

Understanding Dunkin' and Starbucks' location dynamics is crucial for assessing consumer behavior, optimizing site selection, and strengthening competitive positioning. Retail location intelligence analyzes demographic trends, foot traffic patterns, and regional economic conditions to identify strategic store placements. Both brands utilize Restaurant Data Intelligence Services to refine their expansion plans and maximize revenue potential.

- To enhance its market reach, Dunkin' prioritizes drive-thru accessibility, commuter corridors, and suburban expansion. By leveraging Food Delivery Intelligence Services, the brand ensures efficient operations in high-demand areas, catering to budget-conscious consumers and daily commuters. Additionally, Food Price Dashboard insights help analyze pricing competitiveness in different regions, ensuring affordability aligns with customer expectations.

- On the other hand, Starbucks focuses on high-end commercial districts, densely populated metro areas, and tourist-friendly locations to drive premium sales. With access to Food Delivery Datasets, the brand optimizes its digital presence, ensuring seamless food and beverage delivery in key markets. Through Restaurant Data Intelligence Services, Starbucks continuously evaluates customer preferences, adjusting store layouts and menu offerings to enhance the customer experience.

Conclusion

The rivalry between Dunkin' and Starbucks goes beyond their menu selections and branding—it is fundamentally tied to their geographical footprint. Starbucks has a strong presence in high-income urban areas and coastal states, targeting professionals and affluent consumers. In contrast, Dunkin' thrives in suburban regions, commuter-heavy locations, and the Northeast, appealing to on-the-go customers seeking affordability and convenience.

By analyzing location trends, both brands can refine their expansion strategies, optimize customer engagement, and maximize sales. As retail analytics and technology advance, data-driven insights will be crucial in shaping store placements and business decisions. This ongoing strategic approach ensures that both coffee chains maintain a competitive edge in the ever-evolving U.S. market.

If you are seeking for a reliable data scraping services, Food Data Scrape is at your service. We hold prominence in Food Data Aggregator and Mobile Restaurant App Scraping with impeccable data analysis for strategic decision-making.